|

Originally Posted By OregonShooter: The thing people do after buying a home is push for regulation to insure that no one with less money than they have can afford to live there. View Quote This. I constantly heard idiot Silicon Valley execs saying that the housing had to be limited out there. It was too crowded, too much traffic, etc. So I said, "Fine, you should roll it back to the day before you bought your house." "What!! I didn't mean me!!" Of course not. |

|

|

|

|

Originally Posted By Lou_Daks: I agree with everything quoted in the OP. I am living proof it works. It wasn't mentioned, but the book "The Millionaire Next Door" was life-changing for me. Get it. Read it. Love it. Live it. View Quote It was a great book. At the time it was written, the number of millionaires who got there via owning dry cleaning shops led the list. Not any more, due to WFH and business casual. So you do have to watch out for changing tides. |

|

|

|

|

Originally Posted By SamuelAdams1776: https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcQDGgim21w9xmxNn4wiiesHH81ZOIwT4JQAQb3kuqd4ZQ&s View Quote View All Quotes View All Quotes Originally Posted By SamuelAdams1776: Originally Posted By dcabq: He concluded by saying: “There’s a lot of loud noises out there. I don’t know where that comes from [but] it’s not true that you can’t get ahead. When you convince someone it’s true, you’re stealing their hope and … that’s evil.” [/url] https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcQDGgim21w9xmxNn4wiiesHH81ZOIwT4JQAQb3kuqd4ZQ&s Sam Shepard was a classic Hollywood limousine liberal. His politics can be safely ignored. |

|

|

|

|

|

|

|

|

Originally Posted By OKnativeson: Teachers marry the Lawyer and Engineers. View Quote View All Quotes View All Quotes Originally Posted By OKnativeson: Originally Posted By Kingstrider: Lol teacher what is that guy smoking? Most teachers I know don't make squat. Teachers marry the Lawyer and Engineers. Some do. But, like everyone else. Much more likely to marry someone like themselves. Like another teacher. |

|

|

|

|

Originally Posted By Colo303: That’s 83k post tax a year from 18-30 View Quote View All Quotes View All Quotes Originally Posted By Colo303: Originally Posted By StevenH: Pay yourself first. Say you are unemployed and living in your car, eating at the food bank. You get a job and your first thought is I can rent a room and buy groceries? Fuck that. Keep living in your car, get a $10 planet fitness membership for the showers and free pizza, keep eating at the food bank and max out your Roth IRA. I’m not joking. Most men will make their first million by age thirty. The problem is they don’t keep enough of it. That’s 83k post tax a year from 18-30 I started working at 14. Income went up every year. |

|

|

Life member of CRPA. FPC contributor.

|

|

Originally Posted By dcabq: Dave Ramsey says all Americans have ‘a shot’ at being millionaires — but people in 5 professions stand the best chance Dave Ramsey has shared some sage advice for Americans striving for entry into the millionaire club: drown out the “loud noises” that say it can’t be done and be real about what millionaires really look like today. “Millionaires don’t have jets,” Ramsey told Theo Von on the ‘This Past Weekend’ podcast. “Millionaires don’t have seven cars and houses. They’ve just got a paid-for house and some money [saved] in their retirement [accounts]. That’s what it amounts to.” Hitting the million dollar milestone is possible for many Americans, according to Ramsey, as long as you save and spend your money wisely, avoid bad debt and strategically invest part of your income to help it grow. It also helps if you have a certain type of personality and work in one of these five professions. 5 jobs with the most millionaires Ramsey told Von about a 2023 Ramsey Solutions survey, which quizzed 10,000 millionaires across the U.S. to find out what they do for work and how they built their wealth. The top five careers for millionaires turned out to be: Engineer Accountant (CPA) Teacher Management Attorney Surprisingly, medical doctors and physicians didn’t make the top five. They came in sixth position because, as Ramsey put it, even though “they make a lot of money” they’re “notoriously bad” at managing it. “The interesting thing is, one third of them, 33% made less than $100,000 a year,” said Ramsey. “They were not making bank. They were not earning their way into it real quick.” Ramsey said there’s one thing that people in the top five professions share in common, which is that they are “process people.” By that, he means “they learn the rules and … follow them.” “If you’re an engineer, there’s only one way to build that building [so that] doesn’t fall. If you’re an accountant… there’s one way to do it. Teachers have a lesson plan they have to follow, business has a set of practices [and] attorneys [follow] the law,” he told Von. “All of these are process people so they discovered… the process of living on less than they make, living on a budget, starting to invest, being generous, paying off their house, that kind of stuff.” Busting a million-dollar myth The Ramsey Solutions survey busted the myth that, in order to be a millionaire, you need a big six-figure income or to come from a rich family where you’re set to inherit a pile of cash. Instead, most of the millionaires surveyed got rich through consistent investing, avoiding debt like the plague and smart spending. “The typical millionaire that we found — 89% of them were first generation, meaning they did not inherit their money,” said Ramsey. “That’s good news for everybody — we’ve all got a shot.” The two main items that helped these people hit the million-dollar mark: investing in their company’s 401(k) plan (or a similar tax-advantaged savings mechanism, like an individual retirement account) and buying a house and paying it off. Buying a home and fully paying off the mortgage is easier said than done, especially in today’s high interest rate environment. A recent survey commissioned by real estate brokerage Redfin revealed at almost 40% of current homeowners in the U.S. would not be able to afford their homes if they bought today. But Ramsey said he’s a “huge believer in homeownership” as long as buyers aren’t stupid about what they can truly afford. He said: “Homeownership is a key part in the first $1 million to $10 million of net worth that somebody builds.” He concluded by saying: “There’s a lot of loud noises out there. I don’t know where that comes from [but] it’s not true that you can’t get ahead. When you convince someone it’s true, you’re stealing their hope and … that’s evil.” https://www.yahoo.com/finance/news/dave-ramsey-says-americans-shot-101500107.html View Quote I call that BS. I’ve had several Doctors tell me you spend the first 5-10 years paying off loans. The rest you amass money. There is a reason Doctors don’t retire early. The money is too good. The only teachers I know that are millionaires inherited their money. And I know a lot. |

|

|

17 And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.

|

|

All the usual clueless suspects are chiming in ...

Ramsey says avoid debt, dig into your 401k, and buy property you can afford. And the GD squirts all freak out and go on another boomer bashing, like Hamas walking into a synagogue. My message to all the whining brats: |

|

|

|

|

Originally Posted By OregonShooter: A million dollar net worth isn't much really. I'll need 2.5M in a retirement account to feel comfortable retiring. View Quote Ain't that the truth. We have a few million dollars net worth, and if you had told me the mediocre lifestyle that only a few million dollars of net worth gets you in 2024, back in 1985 when I first started saving and investing, I probably wouldn't have believed you. I know for sure it would have depressed me. . |

|

|

|

|

|

|

A lot of people are millionaires on paper. But I’d say the average Joe is so far in debt, their value would be near $0.

|

|

|

17 And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.

|

|

Im curious to know if when people say they need 4 mm a year, is that just living only off the income it derives, say 160k a year and no debt, are they rich? What about someone that has no debt, has on outside income of 150k a year, and 2mm in a brokerage acct?

|

|

|

peach fuzz

|

|

Originally Posted By jwnc: This. I constantly heard idiot Silicon Valley execs saying that the housing had to be limited out there. It was too crowded, too much traffic, etc. So I said, "Fine, you should roll it back to the day before you bought your house." "What!! I didn't mean me!!" Of course not. View Quote Zoning for your neighborhood is the same way. Many people here dont want apartment complexes built near them, or a mega neighborhood. You wouldn't complain about that, would you? |

|

|

peach fuzz

|

|

|

|

|

There are only two things more beautiful than a good gun—a Swiss watch or a woman from anywhere.

|

|

Silly Sammy Slick sipped six sodas and got sick sick sick.

|

|

It doesn’t matter! We have 6-9 years left. Plan accordingly

|

|

|

1 PETER 3:18 "For Christ also hath once suffered for sins, the just for the unjust, that he might bring us to God, being put to death in the flesh, but quickened by the Spirit;"

|

|

|

|

It’s true.

I got a $4000 bonus when I joined the Army. If I had bought Microsoft stock in 1986 it would be worth approximately $13,600,000 today. |

|

|

You are free to choose but not free from the consequences of your choice

|

|

|

|

|

|

|

Originally Posted By Missilegeek: There are a fuckton of teachers. Probably 100 teachers for every doctor. That's what is misleading about the "data" in the way it's presented. He sent questionnaires to people he knew to be millionaires. Well if 2 out of every 100 teachers is a millionaire, there's going to be more of them than the doctors. Notice that nowhere does he say that a higher percentage of teachers are millionaires than doctors. A lot of teachers have spouses. A lot of them have side jobs, or it's their second career. So not all of them are limited to a teachers salary for life. Even if they were, if they work their whole lives and live below their means, becoming a millionaire is not that hard. View Quote View All Quotes View All Quotes Originally Posted By Missilegeek: Originally Posted By MachRider: I can't believe he put teachers over doctors, dentists, nurses, and actuaries.  There are a fuckton of teachers. Probably 100 teachers for every doctor. That's what is misleading about the "data" in the way it's presented. He sent questionnaires to people he knew to be millionaires. Well if 2 out of every 100 teachers is a millionaire, there's going to be more of them than the doctors. Notice that nowhere does he say that a higher percentage of teachers are millionaires than doctors. A lot of teachers have spouses. A lot of them have side jobs, or it's their second career. So not all of them are limited to a teachers salary for life. Even if they were, if they work their whole lives and live below their means, becoming a millionaire is not that hard. Or the stablity of the teaching job allowed the spouse to have a high risk job that paid well. Like farming(which for first 30+ years is just paying bills and starving, THEN it makes money). Lean years the backup income basically sustains the couple and good years the loans get paid faster, the income gets saved, and in their 60's teh couple can retire nicely. |

|

|

|

|

3-7-77

Proud Member of the Leather Head Mafia “In my opinion, the M1 Rifle is the greatest battle implement ever devised” - George S. Patton |

|

|

|

I made it to 1M+ net worth, by basically following Dave Ramsey's steps. My financial and career path was inadvertently set by my parents, not Dave Ramsay - I remember them always arguing about money when I was a kid in the 70/80s, and I told my young self that I couldn't live like that when I was an adult. I was also laid off in 2002, at a job I moved 3 states over to take, which really opened my eyes to how companies work, risk management and the importance of savings and backup plans.

I'm in the 'management' profession. My focus early career was to do the best job I could at work, in front of the right people, and get all the letters behind my name that I saw the successful people had. My life-long financial strategy has been to avoid any debt, always save at least 15%, and keep enough in savings to give me time to find a good job, if I were to be laid off again. I'm finally just about 'free', in my mind. No debt, decent 401k, high income and own my own home. All that took me about 20 years! It is indeed a process, and it takes a long time if you start with nothing and do it exclusively by yourself. As a 'millionaire', my advice is to practice delayed gratification. You don't need 'most' things right away, or even soon. You can have whatever you want, over a long enough time period. Play the long game, if practical. Live beneath your means, always. |

|

|

|

|

Originally Posted By norseman1: All the usual clueless suspects are chiming in ... Ramsey says avoid debt, dig into your 401k, and buy property you can afford. And the GD squirts all freak out and go on another boomer bashing, like Hamas walking into a synagogue. My message to all the whining brats: /media/mediaFiles/sharedAlbum/2OcFu56-590.gif View Quote 7 pages so far. I’ve never seen a bigger collection of miserable whiny fucking people than here in GD. It’s embarrassing to think these people are supposed fellow 2A supporters |

|

|

|

|

Originally Posted By Missilegeek: I remember people saying this at gun shows in the early 90s. I also heard a lot of this during Obama's first term. View Quote All of those people underestimated the ability of this train to keep chugging along and how long it will take us to arrive at the scene of the crash. |

|

|

Silly Sammy Slick sipped six sodas and got sick sick sick.

|

|

Originally Posted By MissiveGenius: I made it to 1M+ net worth, by basically following Dave Ramsey's steps. My financial and career path was inadvertently set by my parents, not Dave Ramsay - I remember them always arguing about money when I was a kid in the 70/80s, and I told my young self that I couldn't live like that when I was an adult. I was also laid off in 2002, at a job I moved 3 states over to take, which really opened my eyes to how companies work, risk management and the importance of savings and backup plans. I'm in the 'management' profession. My focus early career was to do the best job I could at work, in front of the right people, and get all the letters behind my name that I saw the successful people had. My life-long financial strategy has been to avoid any debt, always save at least 15%, and keep enough in savings to give me time to find a good job, if I were to be laid off again. I'm finally just about 'free', in my mind. No debt, decent 401k, high income and own my own home. All that took me about 20 years! It is indeed a process, and it takes a long time if you start with nothing and do it exclusively by yourself. As a 'millionaire', my advice is to practice delayed gratification. You don't need 'most' things right away, or even soon. You can have whatever you want, over a long enough time period. Play the long game, if practical. Live beneath your means, always. View Quote The problem is at some point delayed gratification went from meaning "don't buy a boat" to "just live in your car and shower at Planet Fitness for a few years" |

|

|

Silly Sammy Slick sipped six sodas and got sick sick sick.

|

|

Originally Posted By OregonShooter: A million dollar net worth isn't much really. I'll need 2.5M in a retirement account to feel comfortable retiring. View Quote True, but more like $5M for me to feel truly comfortable. Health care costs and a wife who refuses to adhere to a budget are the killers for me. |

|

|

|

|

Originally Posted By brasscrossedrifles: The problem is at some point delayed gratification went from meaning "don't buy a boat" to "just live in your car and shower at Planet Fitness for a few years" View Quote View All Quotes View All Quotes Originally Posted By brasscrossedrifles: Originally Posted By MissiveGenius: I made it to 1M+ net worth, by basically following Dave Ramsey's steps. My financial and career path was inadvertently set by my parents, not Dave Ramsay - I remember them always arguing about money when I was a kid in the 70/80s, and I told my young self that I couldn't live like that when I was an adult. I was also laid off in 2002, at a job I moved 3 states over to take, which really opened my eyes to how companies work, risk management and the importance of savings and backup plans. I'm in the 'management' profession. My focus early career was to do the best job I could at work, in front of the right people, and get all the letters behind my name that I saw the successful people had. My life-long financial strategy has been to avoid any debt, always save at least 15%, and keep enough in savings to give me time to find a good job, if I were to be laid off again. I'm finally just about 'free', in my mind. No debt, decent 401k, high income and own my own home. All that took me about 20 years! It is indeed a process, and it takes a long time if you start with nothing and do it exclusively by yourself. As a 'millionaire', my advice is to practice delayed gratification. You don't need 'most' things right away, or even soon. You can have whatever you want, over a long enough time period. Play the long game, if practical. Live beneath your means, always. The problem is at some point delayed gratification went from meaning "don't buy a boat" to "just live in your car and shower at Planet Fitness for a few years" Don't forget you need to eat ramen noodles for every meal too. |

|

|

|

|

Originally Posted By JaredC1: 7 pages so far. I’ve never seen a bigger collection of miserable whiny fucking people than here in GD. It’s embarrassing to think these people are supposed fellow 2A supporters View Quote Miserable and whiny is for people with no sense of adventure. NGMI, personality issue. That said, as much as I enjoy the adventure, I'm willing to acknowledge why some people might spend a lot of time sitting in the parking lot of the grocery store, having intrusive thoughts about that thing on their waist. |

|

|

Silly Sammy Slick sipped six sodas and got sick sick sick.

|

|

|

|

Originally Posted By TOTHEMAX: That is what I was thinking. They are extremely underpaid here. View Quote |

|

|

“All that is necessary for the triumph of evil is for good men to do nothing.”

- Edmund Burke "The price of freedom is eternal vigilance." - Thomas Jefferson |

|

Originally Posted By Bud: Any of them? That's a broad brush there, Flounder. View Quote They lived through a period in which if you arrive at 2024 with less than $1M net worth, in 2024 dollars, yeah, you fucked up somewhere. Doesn't matter where. Could have been medical bills on poorly chosen medical plans, bad investments, bought things that required financing at the wrong parts of the market curve, gambling addiction, bought too many toy vehicles, took too many trips to Europe, or maybe you just somehow managed to never get past the kind of job that in 2024 pays about $20/hr, but there was definitely a really big fuck up somewhere and those boxes are typically checked in triplicate at a minimum. |

|

|

Silly Sammy Slick sipped six sodas and got sick sick sick.

|

|

Originally Posted By norseman1: All the usual clueless suspects are chiming in ... Ramsey says avoid debt, dig into your 401k, and buy property you can afford. And the GD squirts all freak out and go on another boomer bashing, like Hamas walking into a synagogue. My message to all the whining brats: /media/mediaFiles/sharedAlbum/2OcFu56-590.gif View Quote Ramsey is simply an entertainer. Once you understand that, most of the rest will make sense. |

|

|

|

|

Rich people stay rich because they spend like they are poor.

Poor people stay poor because they spend like they are rich. It’s all about habits. Pay yourself first, live below your means, don’t use high interest credit. Starting early and consistent investing will make you a millionaire over time. Each of my kids opened a custodial Roth as soon as they got their first job. Each month they contributed. By the end of the first year, each of them had several thousand already saved. Compounded over 5 decades, with gains, they would have several million each, and since it was Roth it will be tax free. |

|

|

|

|

Originally Posted By brasscrossedrifles: They lived through a period in which if you arrive at 2024 with less than $1M net worth, in 2024 dollars, yeah, you fucked up somewhere. Doesn't matter where. Could have been medical bills on poorly chosen medical plans, bad investments, bought things that required financing at the wrong parts of the market curve, gambling addiction, bought too many toy vehicles, took too many trips to Europe, or maybe you just somehow managed to never get past the kind of job that in 2024 pays about $20/hr, but there was definitely a really big fuck up somewhere and those boxes are typically checked in triplicate at a minimum. View Quote View All Quotes View All Quotes Originally Posted By brasscrossedrifles: Originally Posted By Bud: Any of them? That's a broad brush there, Flounder. They lived through a period in which if you arrive at 2024 with less than $1M net worth, in 2024 dollars, yeah, you fucked up somewhere. Doesn't matter where. Could have been medical bills on poorly chosen medical plans, bad investments, bought things that required financing at the wrong parts of the market curve, gambling addiction, bought too many toy vehicles, took too many trips to Europe, or maybe you just somehow managed to never get past the kind of job that in 2024 pays about $20/hr, but there was definitely a really big fuck up somewhere and those boxes are typically checked in triplicate at a minimum. I'd say triplicate big mistakes, if not daily mistakes are required. I got divorced twice and unless the world falls apart, or I get real unlucky, I will be $1M net worth by 45. Which again is not a lot of money. I drive a beater and live in a below average house. I do have what I consider to be a few nice guns. |

|

|

|

|

Originally Posted By jwnc: Do you change HVAC caps?... View Quote View All Quotes View All Quotes Originally Posted By jwnc: Originally Posted By BoogieCookie: Teacher? I'm just a dumb electrician making 3x or 4x what teachers make in my AO. Do you change HVAC caps?... Electricians have a high wage primarily due to predatory state licensing regimes, where various violent entities have conspired to send men with guns (police) to anyone who dares encroach upon their licensed turf. When I ran my own secondary 200 amp split-phase extension 300 feet, it cost me 1k in underground rated feeder cable and $500 of rental time on a backhoe for a day. Even the cheapest electrician would be $9k to do that. The only way to achieve such margins is to violently destroy the competition, such as sending state enforcers to check you've apprenticed or done slave work for the right people. I respect the *tradesmen* but the trades as organizations are half pyramid scheme and half mob. |

|

|

|

|

|

|

Originally Posted By RayFromJersey: Don't forget you need to eat ramen noodles for every meal too. View Quote View All Quotes View All Quotes Originally Posted By RayFromJersey: Originally Posted By brasscrossedrifles: Originally Posted By MissiveGenius: I made it to 1M+ net worth, by basically following Dave Ramsey's steps. My financial and career path was inadvertently set by my parents, not Dave Ramsay - I remember them always arguing about money when I was a kid in the 70/80s, and I told my young self that I couldn't live like that when I was an adult. I was also laid off in 2002, at a job I moved 3 states over to take, which really opened my eyes to how companies work, risk management and the importance of savings and backup plans. I'm in the 'management' profession. My focus early career was to do the best job I could at work, in front of the right people, and get all the letters behind my name that I saw the successful people had. My life-long financial strategy has been to avoid any debt, always save at least 15%, and keep enough in savings to give me time to find a good job, if I were to be laid off again. I'm finally just about 'free', in my mind. No debt, decent 401k, high income and own my own home. All that took me about 20 years! It is indeed a process, and it takes a long time if you start with nothing and do it exclusively by yourself. As a 'millionaire', my advice is to practice delayed gratification. You don't need 'most' things right away, or even soon. You can have whatever you want, over a long enough time period. Play the long game, if practical. Live beneath your means, always. The problem is at some point delayed gratification went from meaning "don't buy a boat" to "just live in your car and shower at Planet Fitness for a few years" Don't forget you need to eat ramen noodles for every meal too. While working 100-hour weeks. This place is mostly ridiculous when it comes to financial advice. As usual, some of the specifics from the SMEs/practicioners that don't get run off can be useful though, like @SiVisPacem walking us through gift tax the other day. |

|

|

|

|

I understand that Dave is trying to help people despite being a hippocrite, but here's the issue which should suprise no one.

Your net worth is what you own minus what you owe. It's the total value of all your assets—including your house, cars, investments and cash—minus your liabilities (things like credit card debt, student loans, and what you still owe on your mortgage). These people may be millionaires...but they aren't liquid. I'd like to see the list again when you take out your primary residence. It will look much different. |

|

|

|

|

Originally Posted By OregonShooter: A million dollar net worth isn't much really. I'll need 2.5M in a retirement account to feel comfortable retiring. View Quote Where does this bullshit come from? How many people have retired without 2.5 million in the bank? Is everyone who retires going to become a jetsetter flying first class to luxury resorts every other week? |

|

|

|

|

Millionaire...LOL

I am a BULLIONAIRE! |

|

|

|

|

|

|

Originally Posted By godzillamax: I'd be interested in seeing the data on teachers and how Ramsey ascertained so many are millionaires in retirement. My wife has been a public middle school teacher for 30 years and has taught in a very affluent school district for the past 17 years. She got her masters degree 20-22 years ago and in 2023 made $95k salary. Fresh grad teachers in her district start around $50-$60k salary. When my wife retires her pension + 403b will make for a nice retirement, but no way will her net worth even remotely be a million dollars (but I guess with a gov pension that depends on how it's valued over the course of her retirement). View Quote He calculates net worth as: House+ savings (retirement, brokerage, bank accounts ) - expenses. So if you paid 400 g for your house and owe 200 g you have 200 net worth + retirement and savings |

|

|

|

|

“The number one profession amongst these millionaires was engineers,” says Hogan. “That doesn’t surprise me; they’re good at planning.” View Quote https://www.rd.com/list/careers-millionaire/ If we want our nation to get richer instead of poorer... apparently we need a lot more engineers in Washington... so those beltway dipshits don't dig our country further into the hole. |

|

|

|

|

Originally Posted By Missilegeek: I remember people saying this at gun shows in the early 90s. I also heard a lot of this during Obama's first term. View Quote I’ve been hearing it my whole as well. Fortunately I put my trust in the Word vs gun show speak, and political garbage. Plan accordingly |

|

|

1 PETER 3:18 "For Christ also hath once suffered for sins, the just for the unjust, that he might bring us to God, being put to death in the flesh, but quickened by the Spirit;"

|

|

|

|

Originally Posted By MissiveGenius: As a 'millionaire', my advice is to practice delayed gratification (except guns). You don't need 'most' things right away, or even soon. You can have whatever you want, over a long enough time period. Play the long game, if practical. Live beneath your means, always. View Quote FIFY. |

|

|

|

|

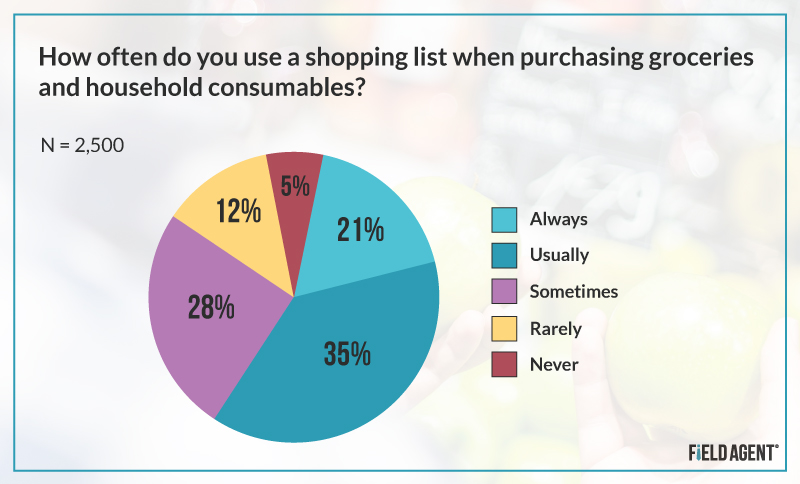

Originally Posted By R_S: This is an interesting tidbit from the Ramsey study: https://cdn.ramseysolutions.net/media/blog/retirement/investing/national-study-millionaires-infographic-6.jpg A bit of advice from the top... make a list for ALL your shopping. Keeps you from wasting money on shit you don't need or will later regret. View Quote 5% of the general population claims to never use a list, which means millionaires favor not making a list over the proles and not making a list indicates slight statistical leaning towards you being a millionaire. I will say when I worked as a delivery boy millionaires did give me a list because that's how they got their servants to go buy them food. The list was usually to whole foods or some other insanely expensive foodstuff retailer. Perhaps at the upper end of millionaires it's basically always a list -- for the maid. As usual, Dave Ramsey is an entertainer with a rather elementary understanding of stochastic analysis.

|

|

|

|

|

Originally Posted By R_S: This is an interesting tidbit from the Ramsey study: https://cdn.ramseysolutions.net/media/blog/retirement/investing/national-study-millionaires-infographic-6.jpg A bit of advice from the top... make a list for ALL your shopping. Keeps you from wasting money on shit you don't need or will later regret. View Quote I always spend less when I forget to take my written shopping list. Related: if you want a happy wife, forgetting as much shit as I do and having to say "sorry babe, I'll get it in two weeks but we will just have to do without for now" isn't a good strategy. I'm hanging in there but I'm on thin ice. Also try not to ever forget toilet paper. |

|

|

Silly Sammy Slick sipped six sodas and got sick sick sick.

|

AR15.COM is the world's largest firearm community and is a gathering place for firearm enthusiasts of all types.

From hunters and military members, to competition shooters and general firearm enthusiasts, we welcome anyone who values and respects the way of the firearm.

Subscribe to our monthly Newsletter to receive firearm news, product discounts from your favorite Industry Partners, and more.

Copyright © 1996-2024 AR15.COM LLC. All Rights Reserved.

Any use of this content without express written consent is prohibited.

AR15.Com reserves the right to overwrite or replace any affiliate, commercial, or monetizable links, posted by users, with our own.