|

Posted: 12/29/2020 4:10:41 PM EDT

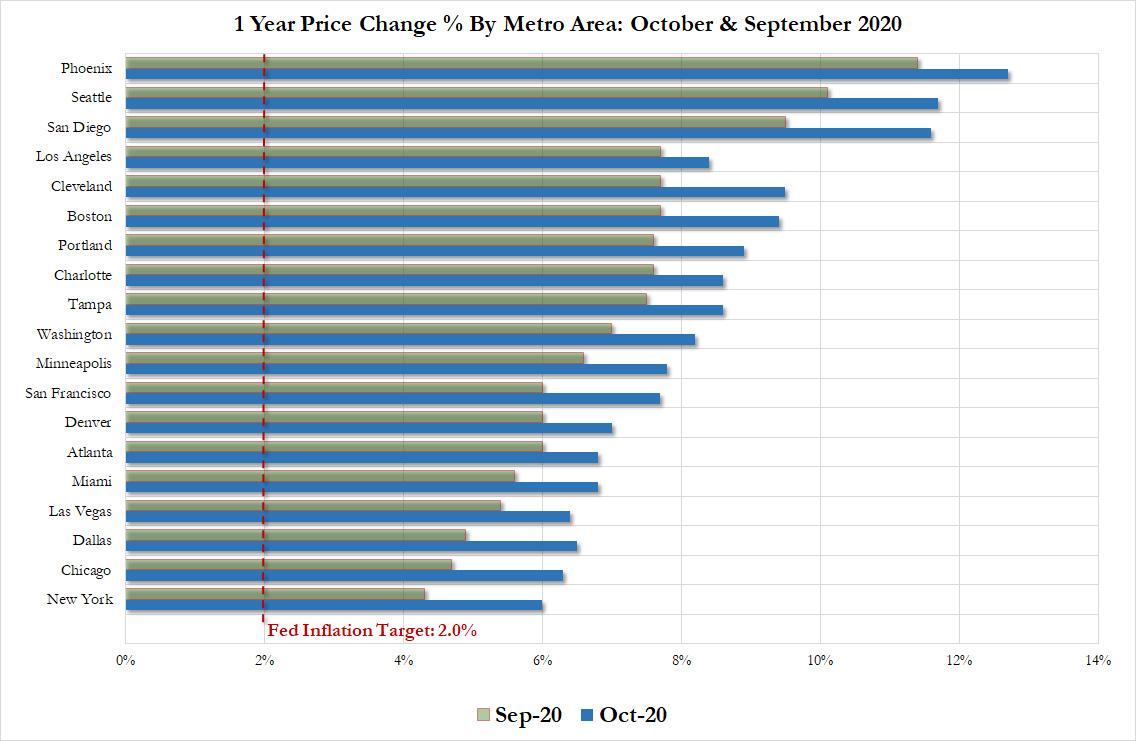

The numbers: The cost of buying a home surged again in October, a closely followed index showed, and prices rose at the fastest rate in six years in a clear sign the housing market is still booming despite a raging pandemic. A measure of home prices in 20 large cities rose at a 7.9% yearly pace in October, according to the S&P CoreLogic Case-Shiller price index. That's up from 6.6% in the prior month. A broader measure by Case-Shiller that covers the entire country, meanwhile, showed a similarly large 8.4% increase in home prices over the past year. That's also up sharply from 7% in the prior month. View Quote https://www.marketwatch.com/story/u-s-home-prices-surge-to-6-year-high-case-shiller-shows-11609251649 I think this might be the first recession where home prices have been making new highs. I can't wait to see what the recovery looks like!  I hope all the people denouncing stimulus checks are also denouncing the welfare they have been receiving from the Fed in the form of artificial asset inflation.  |

|

|

|

Yea housing prices are nuts. We sold a house in 2017 that just sold last month for just over a 40% gain, with only moderate upgrades by the folks we sold to. Pretty crazy!

|

|

|

|

I have sold and bought here in the San Antonio area and the price of our home has gone up and I don't close until Thursday.

|

|

|

|

They cant seem to build them fast enough here in central Florida again.

|

|

|

|

I dun believe it.

Now, if it's city folks fleeing big cities for smaller cities or rural areas with less taxes, then yes. |

|

|

|

|

|

Quoted: I dun believe it. Now, if it's city folks fleeing big cities for smaller cities or rural areas with less taxes, then yes. View Quote This is exactly what's going on around me. While desirable suburbs are seeing an increase the real boom is in anything within a reasonable drive of the city (Cleveland) with 5+ acres. Limited stock and multiple offers on the first day on the market. |

|

|

|

|

|

Quoted: https://cms.zerohedge.com/s3/files/inline-images/1%20year%20price%20change%20major%20cities%20append.jpg?itok=xcBtoPOl The numbers: The cost of buying a home surged again in October, a closely followed index showed, and prices rose at the fastest rate in six years in a clear sign the housing market is still booming despite a raging pandemic. A measure of home prices in 20 large cities rose at a 7.9% yearly pace in October, according to the S&P CoreLogic Case-Shiller price index. That's up from 6.6% in the prior month. A broader measure by Case-Shiller that covers the entire country, meanwhile, showed a similarly large 8.4% increase in home prices over the past year. That's also up sharply from 7% in the prior month. View Quote https://www.marketwatch.com/story/u-s-home-prices-surge-to-6-year-high-case-shiller-shows-11609251649 I think this might be the first recession where home prices have been making new highs. I can't wait to see what the recovery looks like!  I hope all the people denouncing stimulus checks are also denouncing the welfare they have been receiving from the Fed in the form of artificial asset inflation. https://fred.stlouisfed.org/graph/fredgraph.png?width=880&height=440&id=WSHOMCB View Quote Not artificial about it. Its literally the consequence of money printer go brrrrr fed policy. We are rapidly devaluing the currency, while actual value of a house is constant. It just costs more and more monopoly money to buy it. |

|

|

|

Means nothing to me - don't plan on selling & rebuying anytime soon. I rode out the great recession to much lower property taxes that are capped annually.

|

|

|

|

|

|

Our neighborhood is up 7.5% in the last 30 days alone. Crazy.

|

|

|

|

Quoted: Not artificial about it. Its literally the consequence of money printer go brrrrr fed policy. We are rapidly devaluing the currency, while actual value of a house is constant. It just costs more and more monopoly money to buy it. View Quote I consider it an artificial intervention when the Fed or govt steps in to prop up prices. The consequences are definitely very real. Housing prices would naturally be deflating had the Fed and govt not intervened. That's why I say this is artificial growth. |

|

|

|

My neighbor two door downs paid $710k cash for her house, then easily dropped another $300k into it to making it her style. When she finished the house the one in between us came up for sale, she paid $970k cash for it, architect was out yesterday drawing up plans for the remodel. I asked he if she is moving next door, it is a bigger home and a mid century modern, she said "no, I just wanted to pick my neighbor." Now that's fuck you money

|

|

|

|

I just sold my first home for an amount that it really is not worth.

I sold at almost 3x what I owe so it worked out. |

|

|

|

Quoted: Means nothing to me - don't plan on selling & rebuying anytime soon. I rode out the great recession to much lower property taxes that are capped annually. View Quote View All Quotes View All Quotes Quoted: Means nothing to me - don't plan on selling & rebuying anytime soon. I rode out the great recession to much lower property taxes that are capped annually. These artificial valuations have a big psychological impact on a lot of people. They are looking at their rising prices and thinking "wow, I'm getting wealthier" and they then proceed to take out HELOC's to pay for stupid shit, or just spend more money in general and save less because they can afford it now since their homes and stocks are worth so much. It's literally a Fed policy to create this type of behavior. They call it the wealth effect and it's supposed to stimulate the economy. Never mind the fact that it is not stimulating real sustainable growth. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion. https://www.federalreserve.gov/newsevents/other/o_bernanke20101105a.htm |

|

|

|

selling the property I bought 3 years ago for a 50% increase, feels good.

keeping my existing house with no plans of selling, will do some nice upgrades with the profits tho |

|

|

|

I'm sure this is in no way related to the plummeting value of the dollar.

|

|

|

|

purchase prices are based on total annual cost of home ownership for the typical homeowner - so its principal + interest + tax. Supply is fairly inelastic, so prices go up as interest goes down.

|

|

|

|

|

|

Quoted: Because you probably make financially prudent decisions unlike a large swath of Americans. These artificial valuations have a big psychological impact on a lot of people. They are looking at their rising prices and thinking "wow, I'm getting wealthier" and they then proceed to take out HELOC's to pay for stupid shit, or just spend more money in general and save less because they can afford it now since their homes and stocks are worth so much. It's literally a Fed policy to create this type of behavior. They call it the wealth effect and it's supposed to stimulate the economy. Never mind the fact that it is not stimulating real sustainable growth. https://www.federalreserve.gov/newsevents/other/o_bernanke20101105a.htm View Quote Generally a bad decision regardless of economic conditions. |

|

|

|

I'm looking to buy one by the time my lease is up in June. Very annoying

|

|

|

|

Quoted: I hope all the people denouncing stimulus checks are also denouncing the welfare they have been receiving from the Fed in the form of artificial asset inflation. View Quote Do you really need to live close to the office when you don't go into the office? I have a buddy who has been into his office twice since March; once to get some stuff out of his desk and another time to get his laptop fixed by IT. My wife has been to her office twice; once to grab her computer and another time to pick up an additional monitor. For the more restrictive places, is it really worth it paying to live near the cool bars and restaurants when they are closed, take-out only, or have low capacity limits? I wouldn't think so and if I were in that situation, I'd look to get away from all that. |

|

|

|

Money is becoming worth less (or worthless)

Ubranites in blue cities are fleeing for the suburbs and rural areas. The residents of those areas are fleeing to red, rural states Cost of building is going through the roof (materials and regulatory costs) This is probably only the beginning. Wait until amnesty is announced and 1/3 of latin america landrushes the border to join their 30m counterparts already in the USA. The white and black flight out of big cities in blue state border areas is going to be epic. Somewhere around that same time, Xiden will announce that the federal government is going to adopt CA's building and green energy codes, driving the cost of houses even higher. |

|

|

|

Quoted: I'm looking to buy one by the time my lease is up in June. Very annoying View Quote Save up $20k for a down payment one year and think you're getting ahead, then watch home prices rise $40k. Awesome! I'm not comfortable with the idea of spending over 50% of my income on living expenses, having no rainy day fund and not saving any money, so I cannot live comfortably like that and I don't really want to deal with roommates. I'm the stupid one though because even if you did fail to plan for emergencies, live paycheck to paycheck and stumble into hard times the government will just bail you out with extended mortgage forbearance, and your property values will continue to rise. Nothing pisses me off more than watching the government do everything it can to fuck savers and reward recklessness. |

|

|

|

It cannot go on forever.

Incomes haven't even come close to increasing in line with housing costs. The end result is going to be messy... |

|

|

|

Quoted: purchase prices are based on total annual cost of home ownership for the typical homeowner - so its principal + interest + tax. Supply is fairly inelastic, so prices go up as interest goes down. View Quote That has an impact, but prices are really based on what it would cost to create a comparable home. In a lot of places there just isn't anywhere left to build, so prices reflect a lot more compliance costs, and even the cost of buying a lesser house, tearing it down and building another in some cases. Lots of cheap money floating around means monthly payments are lower, but it also means everything costs more. Right now there are shortages of most of the things you need to build a house too. |

|

|

|

|

|

2 out of 3 properties I put bids on this year went for significantly above asking price.

The one we paid ~94% of asking price. |

|

|

|

|

|

Money printer goes brrrt

Everything is going up in price, not just housing. |

|

|

|

Quoted: That has an impact, but prices are really based on what it would cost to create a comparable home. In a lot of places there just isn't anywhere left to build, so prices reflect a lot more compliance costs, and even the cost of buying a lesser house, tearing it down and building another in some cases. Lots of cheap money floating around means monthly payments are lower, but it also means everything costs more. Right now there are shortages of most of the things you need to build a house too. View Quote Without Fed and govt intervention people would be forced to economize. People would have to move in with friends and family. Prices for smaller homes might increase as people downsize, but larger homes would fall in price and entrepreneurial people could buy them at a steep discount and start renting out rooms and everyone can better live within their means. Mortgage rates would be rising, not falling. Builders would have to start building more budget friendly starter homes because that is where the demand would be instead of the 2500+sqft monsters that they seem to be exclusively making now. |

|

|

|

This market certainly is crazy!

My neighbor next door is making her renter move and she is selling her house. She has it listed for $455,000.00! The last house that sold in the spring is across the street from me and it was sold for $287,000.00. This is good for my property value big time! |

|

|

|

Maybe its not hair dressers and waitresses driving the economy? New land development is off the rails.

|

|

|

|

Quoted: I consider it an artificial intervention when the Fed or govt steps in to prop up prices. The consequences are definitely very real. Housing prices would naturally be deflating had the Fed and govt not intervened. That's why I say this is artificial growth. View Quote View All Quotes View All Quotes Quoted: Quoted: Not artificial about it. Its literally the consequence of money printer go brrrrr fed policy. We are rapidly devaluing the currency, while actual value of a house is constant. It just costs more and more monopoly money to buy it. I consider it an artificial intervention when the Fed or govt steps in to prop up prices. The consequences are definitely very real. Housing prices would naturally be deflating had the Fed and govt not intervened. That's why I say this is artificial growth. Serious question, free money does de-valuate the dollar, but we have been putting over 6 BILLION a month into SNAP (food stamps) alone for years (this does not include all the other social handouts, just food stamps). That went to 1 in 7 alive in the US. How does the past $1900 and this $600 single handouts change that much? |

|

|

|

Quoted: Serious question, free money does de-valuate the dollar, but we have been putting over 6 BILLION a month into SNAP (food stamps) alone for years (this does not include all the other social handouts, just food stamps). That went to 1 in 7 alive in the US. How does the past $1900 and this $600 single handouts change that much? View Quote So on top of all the traditional welfare programs we have spent: $400 billion for direct stimulus checks ($780 billion if they bump the 600 dollar one up to 2000) and $380 billion in enhanced unemployment benefits $780 Billion total right now or $1.16 Trillion if they bump up the $600 to $2,000. And again, that is not including SNAP and the other federal welfare programs that have likely grown. And in addition to all of that the has been massive spending at state and local levels with the assumption that they will receive a federal bailout in the near future. So all in all we have crammed about 5 years of spending into one, and 2021 isn't looking too bright either. When everyone is comfortable going out again post-pandemic, that's when things are going to really get ugly, because now we have all this extra money in the system that is going to start sloshing all over everything, instead of being exported to China for trinkets on amazon. I don't know precisely how or where inflation will present itself, but when it does I suspect it will start happening fast. Might be like the toilet paper psychology where people go to the supermarket one day, something sells out when it probably shouldn't have, word spreads and then holy shit. Paradigm shift. Cost inputs rise, maybe trade tensions amp it up further, who knows. The Point is, once inflation starts creeping in, there's no way it goes away on its own without hiking interest rates, and hiking interest rates will kill the over-levered economy and force the govt into austerity. It's possible we tip over on the other side and have deflation as well, but I just don't think people have the stomach to allow widespread bankruptcies and defaults. This has been probably the only recession where corporate debt overall has blown up further instead of deleveraging. |

|

|

|

Quoted: I've just accepted the fact that I will never own a home until prices come back to reality. If you don't already have equity, you're fucked in this game. Save up $20k for a down payment one year and think you're getting ahead, then watch home prices rise $40k. Awesome! I'm not comfortable with the idea of spending over 50% of my income on living expenses, having no rainy day fund and not saving any money, so I cannot live comfortably like that and I don't really want to deal with roommates. I'm the stupid one though because even if you did fail to plan for emergencies, live paycheck to paycheck and stumble into hard times the government will just bail you out with extended mortgage forbearance, and your property values will continue to rise. Nothing pisses me off more than watching the government do everything it can to fuck savers and reward recklessness. View Quote |

|

|

|

I live in a kinda dead area of PA.

When I go to sell it won't surprise me if it sits for at least six months. |

|

|

|

|

|

We could be headed for stagflation. Higher prices following low interest rates and a larger money supply, but people aren't necessarily buying things. They are paying off debt. Wages do not appear to be increasing, only asset prices. Especially for lower wage earners.

The Fed is once again pushing on a string. If they perceive that they are losing control of prices and have "inflation" then one of their main tools is interest rate increases. I hope everything comes up roses. But we are in uncharted waters here. |

|

|

|

Lumber prices have gone up as much as 50% on account of the plandemic having mills shut down. Has nothing to do with money printers or the like. Supply/demand, just like with ammo. They will come back down unless the dollar is weakened enough.....which I fully expect it to be.

|

|

|

|

Housing is insane right now. Trying to move more rural, but even rural prices are through the roof right now. I would love to sell, just not sure how to make it happen right now. Aggressively saving.

|

|

|

|

I nearly trippled my land investment in two years in N. Idaho.

Lots of Californians with deep pockets from real estate sales fleeing. |

|

|

|

Quoted: Not artificial about it. Its literally the consequence of money printer go brrrrr fed policy. We are rapidly devaluing the currency, while actual value of a house is constant. It just costs more and more monopoly money to buy it. View Quote View All Quotes View All Quotes Quoted: Quoted: https://cms.zerohedge.com/s3/files/inline-images/1%20year%20price%20change%20major%20cities%20append.jpg?itok=xcBtoPOl The numbers: The cost of buying a home surged again in October, a closely followed index showed, and prices rose at the fastest rate in six years in a clear sign the housing market is still booming despite a raging pandemic. A measure of home prices in 20 large cities rose at a 7.9% yearly pace in October, according to the S&P CoreLogic Case-Shiller price index. That's up from 6.6% in the prior month. A broader measure by Case-Shiller that covers the entire country, meanwhile, showed a similarly large 8.4% increase in home prices over the past year. That's also up sharply from 7% in the prior month. https://www.marketwatch.com/story/u-s-home-prices-surge-to-6-year-high-case-shiller-shows-11609251649 I think this might be the first recession where home prices have been making new highs. I can't wait to see what the recovery looks like!  I hope all the people denouncing stimulus checks are also denouncing the welfare they have been receiving from the Fed in the form of artificial asset inflation. https://fred.stlouisfed.org/graph/fredgraph.png?width=880&height=440&id=WSHOMCB Not artificial about it. Its literally the consequence of money printer go brrrrr fed policy. We are rapidly devaluing the currency, while actual value of a house is constant. It just costs more and more monopoly money to buy it. You are correct. |

|

|

|

Quoted: I hope all the people denouncing stimulus checks are also denouncing the welfare they have been receiving from the Fed in the form of artificial asset inflation. View Quote  ‘Splain something to me OP, if the house price is overinflated out of someone’s control and subject to bubble bursting how is that at all the same as handing someone a gimme dat check? Existing homeowners don’t exactly have a say in fed interest rate policy and new home buyers are screwed by repricing that happens when rates go down AND by the bubble bursting later. But no, printer goes brrr is not for any citizens long term benefit. |

|

|

AR15.COM is the world's largest firearm community and is a gathering place for firearm enthusiasts of all types.

From hunters and military members, to competition shooters and general firearm enthusiasts, we welcome anyone who values and respects the way of the firearm.

Subscribe to our monthly Newsletter to receive firearm news, product discounts from your favorite Industry Partners, and more.

Copyright © 1996-2024 AR15.COM LLC. All Rights Reserved.

Any use of this content without express written consent is prohibited.

AR15.Com reserves the right to overwrite or replace any affiliate, commercial, or monetizable links, posted by users, with our own.