|

Posted: 4/17/2019 2:52:20 PM EDT

I see lot's of threads on here with people spending lots of money and not having a good path forward. Quite often I see people making excuses for why they can't get ahead. It got me wondering, how many people here REALLY want to be a millionaire and work towards that goal?

|

|

|

Travie McCoy: Billionaire ft. Bruno Mars [OFFICIAL VIDEO] |

|

|

|

|

|

It'd be nice, but you guys keep me broke. Once I get banned from here, I'll be rich.

|

|

|

|

Quoted:

I’m working hard to have a comfortable retirement. View Quote |

|

|

|

|

|

|

|

I wouldn't mind it but the career paths it would take to get there are not something that interest me.

I'm moving towards a nice life and a solid retirement. I don't value just money itself enough to sacrifice other portions of my life in pursuit of it. |

|

|

|

Quoted:

I wouldn't mind it but the career paths it would take to get there are not something that interest me. I'm moving towards a nice life and a solid retirement. I don't value just money itself enough to sacrifice other portions of my life in pursuit of it. View Quote Is your solid retirement pension based? |

|

|

|

Don't care. I live very cheap. Once my 2nd home is paid off (6 years) I will be comfortable on $15k per year.

|

|

|

|

|

|

|

|

On track, almost there, with a slight detour. 3 kids in college, just bought a new house, cash flow has been negatively impacted for a bit, will be back on track in a few years.

Currently contributing over $50k a year, expect to retire in 15-20 years. |

|

|

|

Yes, and I'm working hard by dumping money into my investments.

And buying the occasional lotto ticket. |

|

|

|

Millionaire is a pretty wide range (1M-999M). My wife (age 45) & I (age 50) broke into this group in the last few years. We have two professional jobs, so we're well off (as long as we keep working), but we don't feel rich. We certainly don't feel like we have enough set aside to retire yet. Being a millionaire isn't what it used to be (and isn't as hard to attain as it used to be). A net worth of 1M isn't remotely close to a net worth of 25M, much less 250M. Lifestyles and security will vary greatly depending on how far you penetrate the millionaire range.

|

|

|

|

You meant "multi millionaire"?

Because "millionaire" does not mean earnings of $1M/yr. It means assets exceeding liabilities by that amount, of which I do. |

|

|

|

Quoted:

Millionaire is a pretty wide range (1M-999M). My wife (age 45) & I (age 50) broke into this group in the last few years. We have two professional jobs, so we're well off (as long as we keep working), but we don't feel rich. We certainly don't feel like we have enough set aside to retire yet. Being a millionaire isn't what it used to be (and isn't as hard to attain as it used to be). A net worth of 1M isn't remotely close to a net worth of 25M, much less 250M. Lifestyles and security will vary greatly depending on how far you penetrate the millionaire range. View Quote |

|

|

|

|

|

Are you asking if you wish to be divorced from caring about your everyday expenditures or caring about if you can afford that golf corse over there?

Because there is a pretty big distinction |

|

|

|

Trying but g-damned PSA keeps sending me email alerts and halting my progress.

|

|

|

|

is stupid 'want to be a millionaire'...

i have relatives that talk about getting a break, like a friend they knew who happened to buy home depot stock at the right time or apple. they want that 'million'. from my perspective, it aint about 'making a milion', its about 'having enough'. for now and for when you retire. its about being able to maintain a level of lifestyle indefinitely. that might be a million and it might be 5 million. but the idea is not making a number and then youre done. its about making enough so that you are never worried about being 'done'. so many folks talk about 'if i had a million i would do this or that'. well.. what would you do AFTER you've done 'this or that'? |

|

|

|

No fucks given so long as I'm happy, healthy, and have 2nd amendment rights that I can live with.

Money does not bring happiness but it solves "problems" faster. |

|

|

|

Quit my job as an engineer and bought a CNC machine. I jumped off a cliff hoping that I can build a small empire. But I also want to just work alone and never have any employees.

I'm so conflicted in this regard that it might ruin me. But also working on designs, hoping I can pay others to manufacture while I only assemble, stock, market, and ship. We'll see! It's been about 2 years now and I'm still living month to month just praying that customers pay on time. But slowly growing contacts and business and capability and KNOWLEDGE. If I had bought several lawn mowers and farmed out the help I'd probably be better off. But I'm after more than just money. I'm semi-following my passion, but on the way to fully following it. |

|

|

|

I really don't care. I want to be comfortable, enjoy life as much as that's possible while I'm healthy enough to do it, and if, after retiring my health or ability to maintain that comfort level is gone, I'll flip the switch and see what comes next.

|

|

|

|

Quoted:

On track, almost there, with a slight detour. 3 kids in college, just bought a new house, cash flow has been negatively impacted for a bit, will be back on track in a few years. Currently contributing over $50k a year, expect to retire in 15-20 years. https://www.AR15.Com/media/mediaFiles/145716/fidelity_balance_jpg-915553.JPG View Quote

Nice! I'm saving about $40k/yr right now. I'm hoping to take a new job soon for ~$30k/yr more. Quite a bit will go towards a new house if it happens (higher cost of living area), but it should still improve net worth over time. My current house will then become a rental. Ideally, I'll also be able to put ~$10k more a yr back. I haven't yet decided how to handle the kids college. That's still a ways away. If nothing else, I'll split my GI bill between them and guide them towards lower cost options. Best case, I'll continue to increase my salary and be able to pay outright without much issue. |

|

|

|

Working to have between 1 and 1.2mil by the time I'm 55 so I can live off the interest.

And I'm doing all of that myself. My wife refuses to invest even a single cent. |

|

|

|

Quoted:

Absolutely. But a million in liquid assets puts you in the top 5% of US households. It's generally enough to live off of for the rest of your life - as long as you're willing to live cheap. View Quote |

|

|

|

Do you want to be a millionaire? View Quote |

|

|

|

Quoted: This but I am also enjoying my younger years at the same time..... I have a good gut feeling I will have dementia when I get older from the 3 prior concussions in my life possible 4 and family history of it. At that point I plan to take a one way trip to the Grand Canyon. View Quote

|

|

|

|

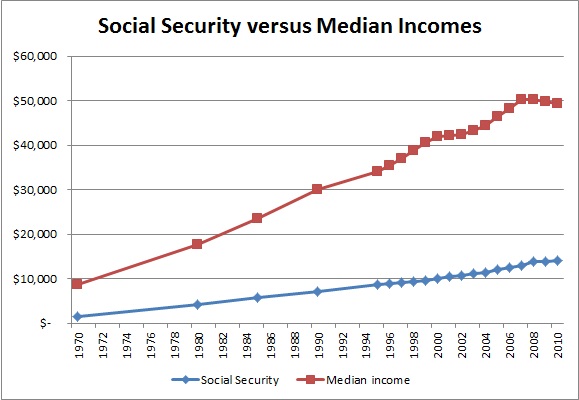

Quoted: the figure thrown about is 4 percent of what you have after retirement per year. 4 percent of a million dollars is 40k. i assume you have social security or similar. how much is that a year and when added to that 40k, is it enough?. say you get 30,000 a year from ss plus 40k from your 'milion'. thats 70k a year. thats not peanuts, but it aint high cotton either. View Quote I won't say my plan stops at 1 million though, I just view that as close to the bottom edge of financial independence. |

|

|

|

I hope to be. And I likely will be in the next 30 or so years. Hopefully my kids will be when I'm gone.

|

|

|

|

|

|

|

|

|

|

Quoted:

A millionaire (if we're talking net worth) is almost a "need-to-be" imperative nowadays as people live longer, have homes valued a lot more, with pressure to prepare for retirement more than before. Large or expensive homes require more continued investment over time in order to be maintained. Nursing home or managed care facilities can run $4000/month and up if you find a decent one with openings. If you don't have a net worth of $1 million around the time of retirement in most suburbs in the US, you're going to be in a precarious position in your sunset years. I remember when $100,000 homes were considered mansions, Uber-wealthy class, and a really nice home went for $30-$40k. Now, a $100k property is a burned-down house maybe in the suburbs, or one that requires substantial work to the tune of $150-$200k just to get it to code and livable. Look at median and average home sale prices from JAN 2000- DEC 2018: https://static.seekingalpha.com/uploads/2019/3/7/saupload_US-median-and-average-new-home-sale-prices-200001-201812.png How much do you need in an IRA to take care of living expenses, properly taxes, and contingencies? Do you plan to purchase more vehicles? What's your plan for assisted living? If your plan is to hope of the best and not plan for any of this, live paycheck to paycheck along with consumer debt and maxed-out auto loans and a mortgage, there is no elasticity in your plan for problems to arise and you risk being devastated if a major change (life) happens. View Quote |

|

|

|

Hate to break the bad news, but a million bucks isn’t really all that much, in terms of retirement...

|

|

|

|

|

|

"Anything for a buck" seems to be the mantra around here, with morals taking a distant second to possessions. Truth be told, the "redistribution" mindset going around on the Left is nothing more than the other side of the coin from many of the rich people on this board. They've found a way to profit off of others, much as people here have. Competition. Nothing more, nothing less. Thing is, they are winning, and their winning would probably benefit me more than the current system.

|

|

|

|

Quoted: Not really. I'd like to be able to afford the basics: food, lodging, travel, my academic degrees and pursuits. View Quote But my family is healthy again. I was on the road all the time and the family was starting to crumble, my kids were becoming teens and needs a strong family, my wife and I have been married over 20 years now, and we get along great again. The money is way down the list of important things to me. That said, we drive used cars, don't carry consumer debt for anything and live modestly. If I can start bringing in more income we will immediately be doing quite well, as we can make it ok on half my previous income- or less. |

|

|

|

Quoted:

"Anything for a buck" seems to be the mantra around here, with morals taking a distant second to possessions. Truth be told, the "redistribution" mindset going around on the Left is nothing more than the other side of the coin from many of the rich people on this board. They've found a way to profit off of others, much as people here have. Competition. Nothing more, nothing less. Thing is, they are winning, and their winning would probably benefit me more than the current system. View Quote I don't think any of us are advocating doing anything to harm others. I guess you could argue that tax minimization strategies are immoral, but I vehemently disagree. |

|

|

|

Quoted:

Lot's of career paths can lead to millionaire status. You just have to invest and give it time. Is your solid retirement pension based? View Quote |

|

|

|

Quoted: I'm not really motivated by it either. I quit a very good paying job with great long-term potential to start my own business. Three years later I still make about half what I did (and doing better each year), but I really don't think I'll be matching that income for years yet. And starting the business was expensive, so we now have very little in the bank. Very. Little. But my family is healthy again. I was on the road all the time and the family was starting to crumble, my kids were becoming teens and needs a strong family, my wife and I have been married over 20 years now, and we get along great again. The money is way down the list of important things to me. That said, we drive used cars, don't carry consumer debt for anything and live modestly. If I can start bringing in more income we will immediately be doing quite well, as we can make it ok on half my previous income- or less. View Quote It sounds like you made a good choice. Retirement can wait a few years when family is on the line. |

|

|

|

Quoted:

Yeah, I wouldn't want to retire with less than a million. A decent pension could offset that need a bit. View Quote View All Quotes View All Quotes Quoted:

Quoted:

A millionaire (if we're talking net worth) is almost a "need-to-be" imperative nowadays as people live longer, have homes valued a lot more, with pressure to prepare for retirement more than before. Large or expensive homes require more continued investment over time in order to be maintained. Nursing home or managed care facilities can run $4000/month and up if you find a decent one with openings. If you don't have a net worth of $1 million around the time of retirement in most suburbs in the US, you're going to be in a precarious position in your sunset years. I remember when $100,000 homes were considered mansions, Uber-wealthy class, and a really nice home went for $30-$40k. Now, a $100k property is a burned-down house maybe in the suburbs, or one that requires substantial work to the tune of $150-$200k just to get it to code and livable. Look at median and average home sale prices from JAN 2000- DEC 2018: https://static.seekingalpha.com/uploads/2019/3/7/saupload_US-median-and-average-new-home-sale-prices-200001-201812.png How much do you need in an IRA to take care of living expenses, properly taxes, and contingencies? Do you plan to purchase more vehicles? What's your plan for assisted living? If your plan is to hope of the best and not plan for any of this, live paycheck to paycheck along with consumer debt and maxed-out auto loans and a mortgage, there is no elasticity in your plan for problems to arise and you risk being devastated if a major change (life) happens. If you need to be told not to count on Social Security, you really need some financial education, which isn't taught in school-quite the contrary.

I have made all my plans with the baseline assumption that Social Security won't be a factor at all in our retirement, even though we've paid into it all these years. Social "Security" is a poverty-level scam perpetrated by FDR and other socialists on the Nation based on the assumption that government knows better than us on how to spend our money for our personal futures. If you look at the costs for homes and assisted living facilities going up steadily each year, then look at what $1 million in liquidity will get you, that equals 11 years on the assumption that costs for a private room in a nursing home will stay flat (they won't). If your family history indicates longevity in your life cycle to 80 years on both sides of your parents, then you need to have $1 million in liquidity when you're in your late 60s, like 68/69 at the latest. That's assuming everything goes as planned. If you treat your children well and they have a large enough home, maybe you can live with them, but any care you will need often has to be provided by professionals, not your 40-50yr-old kids (many of whom are already obese and unproductive at age 20 nowadays, with no signs of learning the value of hard work).

|

|

|

Win a FREE Membership!

Win a FREE Membership!

Sign up for the ARFCOM weekly newsletter and be entered to win a free ARFCOM membership. One new winner* is announced every week!

You will receive an email every Friday morning featuring the latest chatter from the hottest topics, breaking news surrounding legislation, as well as exclusive deals only available to ARFCOM email subscribers.

AR15.COM is the world's largest firearm community and is a gathering place for firearm enthusiasts of all types.

From hunters and military members, to competition shooters and general firearm enthusiasts, we welcome anyone who values and respects the way of the firearm.

Subscribe to our monthly Newsletter to receive firearm news, product discounts from your favorite Industry Partners, and more.

Copyright © 1996-2024 AR15.COM LLC. All Rights Reserved.

Any use of this content without express written consent is prohibited.

AR15.Com reserves the right to overwrite or replace any affiliate, commercial, or monetizable links, posted by users, with our own.