|

Quoted: It was down 5.2%Quoted: Quoted: Quoted: Quoted: eta I apologize to all for acting like a 'know-it-all', that's not my intent, I find myself not trusting any stats because they are all manipulated & based on Lies, in my opinion. eta2 1.3+ Billion People and they depict this as some 'milestone'  China to surpass USA as top luxury car market... 1st edit: No, you don't come across as a "know it all". I suppose anyone who posts an opinion might be accused of that by those who don't like to take a positions on any issue. "Stand for something, or you stand for nothing...." Besides I learn more from debate then agreement. 2nd edit: This is a milestone. If you are a car manufacturer you really don't care what percentage of a population buys your cars, you only care about the number of units you sell. The market which buys the highest number of units is the one you cater to. It is also a milestone, when I can remember clearly China traffic looked more like a wild bicycle race instead of this.... http://chinadigitaltimes.net/wp-content/uploads/mt-old/_photos_uncategorized_20070311_bjroads-tm.jpg I am amazed at how fast they are moving forward. One last note. I thought it was an interesting line from the movie Social Network, "There are more geniuses in China then there are people in the United States". I realize its a controversial statement at best (arguments supporting it and opposing it can be made), but it does give one pause to think... What might they accomplish with more freedom? That's the Trillion Dollar Question...Government Forced 'Freedom' or Free-will? I agree, their growth appears unimaginable, and probably because it isn't real. When WE have everything, it's easy to become Lazy & 'Stupid'. WE lack Passion and Confidence in ourselves because Life has become 'to easy'. I think WE will find OUR Genius again, once WE begin 'Hurting' for what WE earn, instead of expecting it; WE have to hit rock bottom to learn I just can't believe Communism can ever accomplish anything to help it's Citizenry, only use them to push their Agenda by limiting Individual Freedoms Kind of what WE are going through in reverse...Government Control or 'Anarchy' Communism had nothing to do with their recent success. They've admitted that. We imagine that there is some mythical line between "communism" and "capitalism". The other guy is "communist" and we are not. There is no mythical line. There is only MORE government or LESS government central planning. Don't get me wrong, the Chinese still have tremendous problems with central planning. But so do we. We have a tremendous amount of government economic central planning in our society. Right now over half of the households in America receive some sort of direct financial benefit from government. That's a problem. Our economic central planners are killing the coal industry, regulating the food grown on farms, directing the medicine which can be sold and marketed, determining the price for health care, regulating the kind of car you can buy, the kind of house you can live in, the kind food and in some cases the price of that food you eat. There is tremendous risk for a society that is blinded to its own "collectivism". China is no more a pure communist state than we are a pure free-market state. PS: Anarchy isn't as evil as people have been indoctrinated to believe. Most people still have quite a bit of "anarchy" in their daily lives. Those slices of heaven where there is absolutely NO government. I think you'll admit those are the BEST parts of your life. Government should be limited to protecting INDIVIDUAL freedom. That's the only thing it does well.  SO spot on! Did anyone else hear on the news today that shipments of durable goods was down 50% in January, or was I hearing things? |

|

|

|

according to this link, not 50%, but 5.2% down; still significant... most was in defense, apparently

ETA: oops, I'm slow. |

|

|

|

|

|

|

|

Interesting chart I found here -> http://mam.econoday.com/byshoweventfull.asp?fid=456008&cust=mam&year=2013&lid=0&prev=/byweek.asp

To me this seems to say that the yearly (running 12 months, I would assume) change has moved to 0% or slightly negative. Interestingly, Cash for Clunkers went active in July 2009, just as the large deficit started turning upward. |

|

|

|

Quoted: Interesting chart I found here -> http://mam.econoday.com/byshoweventfull.asp?fid=456008&cust=mam&year=2013&lid=0&prev=/byweek.asp To me this seems to say that the yearly (running 12 months, I would assume) change has moved to 0% or slightly negative. Interestingly, Cash for Clunkers went active in July 2009, just as the large deficit started turning upward. History is about to repeat itself when WE look at the bigger picture...  |

|

|

|

Quoted: There were 7 YASBYBIC threads before this. They were stopped only by the old 50 then 100 page limit. MAN! I thought i was depressed concerning the state our nation before reading this thread. After reading all 56 pages I feel even worse. Man you would think someone making decisions for our country would want them to benefit our society in any way. I am disgusted by the greed, lies, and overall shady way our politician do business. sometimes makes it hard to be proud of your great country. I just have to remember what our country stands for, what the people stand for (well most of them). You dont have to believe in our government to believe in our country! Thanks for a great read guys, I learn something new everytime I venture in these threads. Except for the previous, which was shut down by the current OP (original poster) after unlimited pages was put in place. http://media.ak47.net/forums/t_1_5/1162280__ARCHIVED_THREAD____You_Ain_t_Seen_Bad_Yet_But_It_s_Comin___OFFICIAL_Part_7.html&page=131 You can google search for all of them. Originally Posted By America-first Whatever happened to all of those new jobs that the Halfrican was going to conjure up? We're on an elevator ride straight to hell. http://news.yahoo.com/s/nm/20090622/pl_nm/us_obama_unemployment_2 Posted: 6/22/2009 12:51:00 PM PST The post that started it all... http://www.ar15.com/forums/t_1_5/890033_.html&page=1 |

|

|

|

Quoted: Quoted: Interesting chart I found here -> http://mam.econoday.com/byshoweventfull.asp?fid=456008&cust=mam&year=2013&lid=0&prev=/byweek.asp To me this seems to say that the yearly (running 12 months, I would assume) change has moved to 0% or slightly negative. Interestingly, Cash for Clunkers went active in July 2009, just as the large deficit started turning upward. History is about to repeat itself when WE look at the bigger picture... http://www.economicgreenfield.com/wp-content/uploads/2012/10/Dshort-10-25-12-Durable-Goods-Orders-SPX.gif |

|

|

|

Political Special Interest with a Communist Twist...unbelievable

Pentagon welcomes Chinese general who threatened nuclear strikes on hundreds of US cities... |

|

|

|

Quoted:

Quoted:

I was listening to an investment show this morning. Lot of euphoria about the rebounding economy. Made me think  On one hand last week there were some good numbers regarding new home sales. Look like this week will have good job #'s also. On the other hand they claim inflation is low but I surely know my $ isn't going as far as it used to. I know that is just anecdotal evidence but I doubt I'm the only thinking this. The other thing I've been thinking. This seems like the perfect time for Obama & the Dems to let the economy slide. We have all the hype surrounding the sequester and the Repubs letting the cuts hit. Obama can let the economy go to hell now and blame the Repubs. I'm just not sure what to think anymore. Maybe we're all paranoid and things are really turning around. On one hand last week there were some good numbers regarding new home sales. Look like this week will have good job #'s also. On the other hand they claim inflation is low but I surely know my $ isn't going as far as it used to. I know that is just anecdotal evidence but I doubt I'm the only thinking this. The other thing I've been thinking. This seems like the perfect time for Obama & the Dems to let the economy slide. We have all the hype surrounding the sequester and the Repubs letting the cuts hit. Obama can let the economy go to hell now and blame the Repubs. I'm just not sure what to think anymore. Maybe we're all paranoid and things are really turning around.Which investing show? It was a local show. They are investors so I realize they have a product to sell. I also listened to Bob Brinker (I think it was his show), he didn't seem too down on the economy either |

|

|

|

Quoted: Quoted: Any smart Business man would Fire an employee for Gross Incompetence, Why do 'WE' continue to give Politicians a break? Every time I vote I'm trying to fire the incumbent but the SOBs don't get fired. I must be doing it wrong. Power is an illusion. They've managed to trick the public into thinking that the government holds authority and has a monopoly on force. That's a sheer numerical impossibility and yet people still think it's the truth. I wrote something for another thread that I think is fitting with both GlockO and Rich_V's comments. Even after the economy went into free fall, millions of people lost millions of dollars in retirement and investments, millions more lost their homes and businesses, our economy damn near collapsed in on itself, and then .gov took tax payer money and bailed out banks with it...... 40% of the population turned out to vote. Being an elected official is a privilege. We as a nation don't seem to be very effective at revoking that privilege nor keeping the threat of revocation fresh in these peoples minds as they weigh laws. Simply put, our apathy as a nation has ensured that our legislators neither respect or fear us. We created their mindset. We created the opening for them to step into office and operate under separate and unequal laws. We let them gut oversight, we let them operate without budgets, and we let them cash out and walk away after they've had their fill! Before you start advocating and collecting ideas on the best way to fight those who control the most effective fighting force on the surface of this earth, you may want to take steps to see if you can solve the problem with the 1st Amendment and the voting booth first. There has been no real change in leadership in our nation. The same type of people get elected over and over again. Obama is NOT creating laws and smashing them down your throat. The Senate and The House are doing that and hiding BEHIND Obama while they run to the bank. The citizenry feign outrage and then 40% show up to vote... why would they stop? Would you stop? Look at how effective the TEA party was until it was co-opted. It was so terrifying that the GOP changed their nomination rules..... WE CAN WIN if we care to. Read about our founders and just how far they were actually pushed before they took up arms. Their enemies were denying them even the most basic rights, blocking their ports, denying them trade, sleeping in their homes, eating their food.... They didn't sit on their thumbs while this was going on, but they didn't jump right to muskets and cannon either. The truth is we haven't even really given voting these bums out and holding them accountable a fair shake. We all dismiss it and leave it for the other guy to do! Organizing your community, driving people to the polls... going out of your way to help people and setting an example, influence them and talk about what makes a good man, and how we need to keep good people in government. Be the change you want to bring to your world. All of these things have direct impacts on local politics, which has direct influence on state politics, which filters up to national politics. And then, if you win. If we all put the "right" sort of people in power, it's not over. We have to hold them accountable all across the board. However, if you fail, and the worst situations imaginable come to pass... you now have contacts all around your neighborhood and locality. You now have some sort of organization you can call on. You now have people who know you and your character. One of the biggest downfalls of Conservatives is inherent in our "live and let live" nature. We tend to not go out of our way to organize. That HAS to change if we are to defeat the Progressive political machine. Obama has 2.2 million grass roots organizations to call up when he needs help. How many organizations can those who fight for liberty call up? "of the people, for the people, by the people".... the people are on vacation.  |

|

|

|

Quoted: Quoted: Interesting chart I found here -> http://mam.econoday.com/byshoweventfull.asp?fid=456008&cust=mam&year=2013&lid=0&prev=/byweek.asp To me this seems to say that the yearly (running 12 months, I would assume) change has moved to 0% or slightly negative. Interestingly, Cash for Clunkers went active in July 2009, just as the large deficit started turning upward. History is about to repeat itself when WE look at the bigger picture... http://www.economicgreenfield.com/wp-content/uploads/2012/10/Dshort-10-25-12-Durable-Goods-Orders-SPX.gif That looks like a giant head and shoulders pattern.... |

|

|

|

Quoted:

Quoted:

Quoted:

Interesting chart I found here -> http://mam.econoday.com/byshoweventfull.asp?fid=456008&cust=mam&year=2013&lid=0&prev=/byweek.asp To me this seems to say that the yearly (running 12 months, I would assume) change has moved to 0% or slightly negative. Interestingly, Cash for Clunkers went active in July 2009, just as the large deficit started turning upward. History is about to repeat itself when WE look at the bigger picture... http://www.economicgreenfield.com/wp-content/uploads/2012/10/Dshort-10-25-12-Durable-Goods-Orders-SPX.gif 8-10 year durable good lifespan, it goes up, then demand drops as people only are replacing them as needed. Much of the rise in demand wasn't because people wanted to replace goods because they wanted to, they did because they HAD to. I do repairs on household white goods and such, you can't believe the amount of bitching and crying you hear when you tell them it's just not economically feasible to fix the appliance or that the parts are just not available anymore. 10 years ago it was "Meh, I wanted a new one anyways," now it's "I can't really afford to replace this right now, is there any way you can get it working for at least a little while?" |

|

|

|

Quoted: snip 8-10 year durable good lifespan, it goes up, then demand drops as people only are replacing them as needed. Much of the rise in demand wasn't because people wanted to replace goods because they wanted to, they did because they HAD to. I do repairs on household white goods and such, you can't believe the amount of bitching and crying you hear when you tell them it's just not economically feasible to fix the appliance or that the parts are just not available anymore. 10 years ago it was "Meh, I wanted a new one anyways," now it's "I can't really afford to replace this right now, is there any way you can get it working for at least a little while?" Interestingly enough, I just had my best February in several years. But, it wasn't from new builds on manufacturers' lines or in their test labs - it was almost ALL replacement parts for systems that have been in place 8-10 years. |

|

|

|

Quoted:

Quoted:

Q we agree more than it would appear...good discussion.

Communism had nothing to do with their recent success. They've admitted that. We imagine that there is some mythical line between "communism" and "capitalism". The other guy is "communist" and we are not. There is no mythical line. There is only MORE government or LESS government central planning. Don't get me wrong, the Chinese still have tremendous problems with central planning. But so do we. We have a tremendous amount of government economic central planning in our society. That's what WE shouldn't trust. They know exactly what they are doing, so when OUR Politicians discuss 'Special Interest', look no further than China; Why is their slave labor acceptable? Right now over half of the households in America receive some sort of direct financial benefit from government. That's a problem. Our economic central planners are killing the coal industry, regulating the food grown on farms, directing the medicine which can be sold and marketed, determining the price for health care, regulating the kind of car you can buy, the kind of house you can live in, the kind food and in some cases the price of that food you eat. There is tremendous risk for a society that is blinded to its own "collectivism". China is no more a pure communist state than we are a pure free-market state.

WE still have OUR Constitution during these questionable times. PS: Anarchy isn't as evil as people have been indoctrinated to believe. Most people still have quite a bit of "anarchy" in their daily lives. Those slices of heaven where there is absolutely NO government. I think you'll admit those are the BEST parts of your life. Government should be limited to protecting INDIVIDUAL freedom. That's the only thing it does well.

I agree, and that's what the Great 'Lie' is all about...Governments staying Relevant. More Government Regs = Black Markets = Low Grade Anarchy WE either exercise OUR Right to enforce Term-Limits, by voting Most Incumbents Out of Congress in 2014, or WE deserve the Government Controls that will be Force upon US, and I'm not confusing America for China

Any smart Businessman would Fire an employee for Gross Incompetence, Why do 'WE' continue to give Politicians a break? WE don't. You are failing to comprehend that we are in a war for survival of ths country and there are 2 sides. The other side is voting for these traitors. We are not. |

|

|

|

Quoted: You missed my quotation marks...snip Quoted: Q we agree more than it would appear...good discussion. More Government Regs = Black Markets = Low Grade Anarchy WE either exercise OUR Right to enforce Term-Limits, by voting Most Incumbents Out of Congress in 2014, or WE deserve the Government Controls that will be Force upon US, and I'm not confusing America for China  Any smart Businessman would Fire an employee for Gross Incompetence, Why do 'WE' continue to give Politicians a break? WE don't. You are failing to comprehend that we are in a war for survival of ths country and there are 2 sides. The other side is voting for these traitors. We are not. |

|

|

|

Dow Jones high on Fed steroids...

I think many are going to be left with some unsightly 'Gyno' Firemission: A Call for Congressional Hearings the FED is 'Cheating'   |

|

|

|

Quoted:

Dow Jones high on Fed steroids... I think many are going to be left with some unsightly 'Gyno' Firemission: A Call for Congressional Hearings the FED is 'Cheating'

And... The Last Time We Were Here: http://www.zerohedge.com/news/2013-03-05/last-time-dow-was-here Dow Jones Industrial Average: Then 14164.5; Now 14164.5 Regular Gas Price: Then $2.75; Now $3.73 GDP Growth: Then +2.5%; Now +1.6% Americans Unemployed (in Labor Force): Then 6.7 million; Now 13.2 million Americans On Food Stamps: Then 26.9 million; Now 47.69 million Size of Fed's Balance Sheet: Then $0.89 trillion; Now $3.01 trillion US Debt as a Percentage of GDP: Then ~38%; Now 74.2% US Deficit (LTM): Then $97 billion; Now $975.6 billion Total US Debt Oustanding: Then $9.008 trillion; Now $16.43 trillion US Household Debt: Then $13.5 trillion; Now 12.87 trillion Labor Force Particpation Rate: Then 65.8%; Now 63.6% Consumer Confidence: Then 99.5; Now 69.6 S&P Rating of the US: Then AAA; Now AA+ VIX: Then 17.5%; Now 14% 10 Year Treasury Yield: Then 4.64%; Now 1.89% EURUSD: Then 1.4145; Now 1.3050 Gold: Then $748; Now $1583 NYSE Average LTM Volume (per day): Then 1.3 billion shares; Now 545 million shares It inspires hope, doesn't it?

|

|

|

|

|

|

|

|

Quoted:

" When in Greece "

Through the looking glass ... ETA -

http://mail.laruetactical.com/service/home/~/?auth=co&id=26146&part=2 Whoa! |

|

|

|

Quoted:

Quoted:

You missed my quotation marks...snip Quoted: Q we agree more than it would appear...good discussion. More Government Regs = Black Markets = Low Grade Anarchy WE either exercise OUR Right to enforce Term-Limits, by voting Most Incumbents Out of Congress in 2014, or WE deserve the Government Controls that will be Force upon US, and I'm not confusing America for China

Any smart Businessman would Fire an employee for Gross Incompetence, Why do 'WE' continue to give Politicians a break? WE don't. You are failing to comprehend that we are in a war for survival of ths country and there are 2 sides. The other side is voting for these traitors. We are not. My appologies. |

|

|

|

Billionaires Dumping Stocks... It’s very likely that these professional investors are aware of specific research that points toward a massive market correction, as much as 90%.    |

|

|

|

Quoted: Billionaires Dumping Stocks... It’s very likely that these professional investors are aware of specific research that points toward a massive market correction, as much as 90%. If the pattern holds stocks will move up. Keep it simple stupid ride SPY, or even some Pro-share ETF's that use leverage to the upside, mix in some mid-cap ETFs, but don't get fancy, play the demand wave don't waste your time on the individual stocks, and keep your hand on the eject handle. Follow your gains with sell stop limits on the way up, don't be a greedy pig. Commodities will settle lower until they catch the tsunami inflation wave, and ride it higher. You need to be on the coconuts when the 7th wave comes. This is your chance. The bond market is your "dove in the cage" after begins to collapses watch your equity position carefully. The move may be awesome, and fast. So be careful. Watch your stops. Be smart follow the contrarian play and pick up resources and metals as they decline, this is your last chance. But it's a good one. I used this song in lectures long ago. It's a fairly obscure song by Sting from 1985. Love is the 7th wave. Figure out that meaning and you can understand the universe. Yes....you can learn a lot from surfing. |

|

|

|

Quoted:

Billionaires Dumping Stocks... It’s very likely that these professional investors are aware of specific research that points toward a massive market correction, as much as 90%.

Newsmax Aftershock Ripoff Report Newsmax offers an ostensibly "free" copy of the book, Aftershock, and free trials to 3 newsletters as part of their offer, for just the price of $4.95 shipping. That is the only information given before filling out the order form and submitting a credit card. After filling in the form to order the book, a welcome email is sent informing you that the different subscriptions will be billed at different intervals after the trail period if one does not unsubscribe. Aha, when you try to unsubscribe you are told that one must wait to be notified for the end of the trial periods at 2, 3 and 4 month notifications for the different unwanted subscriptions.

When you email customer service to unsubscribe you are then informed of the undisclosed terms and conditions: if you want to unsubscribe you will be billed $27.95 for the full retail price of the book. They've got you!! Adding insult to injury your email is distributed to their affiliates and all the tentacles are out. Please beware and read all the complaints consumers like me have filed. If you do business with Newsmax, use Paypal so they will not be able to bill your credit card for unwanted publications. |

|

|

|

Or you could read 'The Harbinger' instead of catching the 7th Wave........

|

|

|

|

If the stock dumping report is at all accurate, there is some fairly important news there. Buffet's main strategy is NEVER to sell positions. Selling positions creates tax events. His approach has always been to buy and hold. Period. Even if the investment is less than ideal in the long term.

His philosophy is that once an investment is paid for, as long as it spits out any profit at all, that's good enough; certainly better than taxes (ironic considering his stated politics). If an investment stopped making money, he'd get new management, and get it turned around.

|

|

|

|

Quoted:

Quoted:

[/div][div]While not a book on economic systems I would strongly endorse The Wisdom of Crowds by James Surovieki. It's not a technical book and could easily be read quickly. It deals with mob psychology and certain mathematical phenomena that I've spent decades studying. James has done an excellent job illustrating (much better then I could ever hope to do) an absolutely amazing phenomena which most on this thread would find valuable. [/div][div] That is a very interesting book. I read it several years ago shortly after it was published, for a marketing class. But it could be used as evidence against what is thought in this thread as well. Meh, most of us are counter-culture types: even if we wear clothes to blend in, the "thinkers" in this thread are by no means representative of the general population (as you more accurately reference below). :D So although I haven't read the book yet, in the context of group think and this thread - I have actually yet to see the phenomenon here. If anything, this thread remains rather eclectic and diverse in both background and perspective - even after you decided to join the Dark Side.

Now, as far as "group therapy" goes... well that might be a much more accurate summation of things!

Quoted:

I really don't think the average American (the group) really understands how serious an economic situation we have. Unfortunately we now have a majority-near majority of people that are of such mind that they can't make a responsible decision of what to eat for dinner. Let alone decide who runs the government. With this, I agree completely. I would just add something about them all having their hands out and being totally cool with wealth redistribution on a grand scale: as long as it's someone else's wealth and they're getting the distribution! |

|

|

|

Quoted:

...Snip... It inspires hope, doesn't it?  No, it does not. The change in less than six years is quite evident though. |

|

|

|

Quoted:

Quoted:

...Snip... It inspires hope, doesn't it?  No, it does not. The change in less than six years is quite evident though. Not sure if you're just reflecting on the data points I posted, or if there is a broader political innuendo there. But I'll just add this: There's plenty of blame to go `round, but I really can't get on the Anti-Bama Band Wagon too much. Sure, I can say "He's a part of the problem - and he's doing NOTHING to fix the problem," but as we've hinted at in other discussions... the Problem preceeds this administration by no less than a half-dozen decades, arguably four... maybe six Presidential Administrations, three generations and at least a hundred million willful voters (give or take). This administration is just a more glaring and offensive representation of the status quo we've all tried to ignore for so long. But yeah, the rate of change has definitely become measurable, and depending on the chart... exponential. And just in case anyone was wondering: Dear Senator Paul, On February 20, 2013, you write to John Brennan requesting additional information concerning the administration's views about whether "the President has the power to authorize lethal force, such as a drone strike, against a U.S. citizen on U.S. soil, and without trial." As members of this Administration have previously indicated, the US government has not carried out drone strikes in the United States and have no intention of doing so. As a policy matter, moreover, we reject the use of military force where well-established law enforcement authorities in this country provide the best means for incapacitating a terrorist threat. We have a long history of using the criminal justice system to incapacitate individuals located in our country who pose a threat to the United States and its interests abroad. Hundreds of individual have been arrested and convicted of terrorism-related offenses in our federal courts. The question you have posed is entirely hypothetical, unlikely to occur and we hope no president will ever have to confront. It is possible, I suppose, to imagine an extraordinary circumstance in which it would be necessary and appropriate under the Constitution and applicable laws of the United States for the President to authorize the military to use lethal force within the territory of the United States. For example, the president could conceivably have no choice but to authorize the military to use such force if necessary to protect the homeland in the circumstances of a catastrophic attack like the ones suffered on Dec. 7, 1941 and Sept. 11, 2001. Were such an emergency to arise, I would examine the particular facts and circumstances before advising the President on the scope of his authority. Sincerely, Eric Holder, Attorney General http://www.zerohedge.com/news/2013-03-05/dear-american-its-extraordinary-circumstance-and-drones-coming-you I'll be watching the news all week, waiting for the outrage. |

|

|

|

Quoted: Honestly, aren't most media outlets 'Ripping US off' of the Facts?Quoted: ...snip Newsmax Aftershock Ripoff Report Newsmax offers an ostensibly "free" copy of the book, Aftershock, and free trials to 3 newsletters as part of their offer, for just the price of $4.95 shipping. That is the only information given before filling out the order form and submitting a credit card. After filling in the form to order the book, a welcome email is sent informing you that the different subscriptions will be billed at different intervals after the trail period if one does not unsubscribe. Aha, when you try to unsubscribe you are told that one must wait to be notified for the end of the trial periods at 2, 3 and 4 month notifications for the different unwanted subscriptions. When you email customer service to unsubscribe you are then informed of the undisclosed terms and conditions: if you want to unsubscribe you will be billed $27.95 for the full retail price of the book. They've got you!! Adding insult to injury your email is distributed to their affiliates and all the tentacles are out. Please beware and read all the complaints consumers like me have filed. If you do business with Newsmax, use Paypal so they will not be able to bill your credit card for unwanted publications. Everyone has a bias, but the basic info & actions taken are what WE should be paying attention to. 'Doomsday' is becoming more Mainstream... Take Chips Off the Table, Catastrophe Brewing "We're in an inflationary period and it's very difficult to make money. I *Most of these 'Economic Specialists' on TV/Internet aren't living the 'Prosperous' Lives they depict. They've borrowed a lot, rent 'fancy cars' & rent in the 'Hot' Spots, so the perception is they have their sh!t together, meanwhile, they can't pay Child support & live very reckless lives. still have a target of 5,000 for the Dow that we should reach in 2017 or 2018, and then we'll get a huge bull market so it's best just to go to sleep with your money until then," he said. "People should be asking, 'How much can I lose?' rather than 'How much can I make?'" Investing Arrogance causes the Markets to Crash, i.e. "Trust Me, would I have that Bentley if I thought we should be concerned? Now, about my commission..." |

|

|

|

Quoted: ...so does anyone have any info on how to live underground?Quoted: Quoted: ...Snip... It inspires hope, doesn't it?  No, it does not. The change in less than six years is quite evident though. Not sure if you're just reflecting on the data points I posted, or if there is a broader political innuendo there. But I'll just add this: There's plenty of blame to go `round, but I really can't get on the Anti-Bama Band Wagon too much. Sure, I can say "He's a part of the problem - and he's doing NOTHING to fix the problem," but as we've hinted at in other discussions... the Problem preceeds this administration by no less than a half-dozen decades, arguably four... maybe six Presidential Administrations, three generations and at least a hundred million willful voters (give or take). This administration is just a more glaring and offensive representation of the status quo we've all tried to ignore for so long. But yeah, the rate of change has definitely become measurable, and depending on the chart... exponential. And just in case anyone was wondering: Dear Senator Paul, On February 20, 2013, you write to John Brennan requesting additional information concerning the administration's views about whether "the President has the power to authorize lethal force, such as a drone strike, against a U.S. citizen on U.S. soil, and without trial." As members of this Administration have previously indicated, the US government has not carried out drone strikes in the United States and have no intention of doing so. As a policy matter, moreover, we reject the use of military force where well-established law enforcement authorities in this country provide the best means for incapacitating a terrorist threat. We have a long history of using the criminal justice system to incapacitate individuals located in our country who pose a threat to the United States and its interests abroad. Hundreds of individual have been arrested and convicted of terrorism-related offenses in our federal courts. The question you have posed is entirely hypothetical, unlikely to occur and we hope no president will ever have to confront. It is possible, I suppose, to imagine an extraordinary circumstance in which it would be necessary and appropriate under the Constitution and applicable laws of the United States for the President to authorize the military to use lethal force within the territory of the United States. For example, the president could conceivably have no choice but to authorize the military to use such force if necessary to protect the homeland in the circumstances of a catastrophic attack like the ones suffered on Dec. 7, 1941 and Sept. 11, 2001. Were such an emergency to arise, I would examine the particular facts and circumstances before advising the President on the scope of his authority. Sincerely, Eric Holder, Attorney General http://www.zerohedge.com/news/2013-03-05/dear-american-its-extraordinary-circumstance-and-drones-coming-you I'll be watching the news all week, waiting for the outrage.    "Fluency in English is something that I'm often not accused of."-George H.W. Bush "It depends on what the meaning of the words 'is' is." –Bill Clinton "I'll be long gone before some smart person ever figures out what happened inside this Oval Office." -George W. Bush Fanboy, 'Hey Mr. President, what is your definition of a terrorist?' Obama, 'Uuuuuuhhhhhh...I would like to quote my predecessors...' |

|

|

|

Quoted: Quoted: ...so does anyone have any info on how to live underground?Quoted: Quoted: ...Snip... It inspires hope, doesn't it?  No, it does not. The change in less than six years is quite evident though. Not sure if you're just reflecting on the data points I posted, or if there is a broader political innuendo there. But I'll just add this: There's plenty of blame to go `round, but I really can't get on the Anti-Bama Band Wagon too much. Sure, I can say "He's a part of the problem - and he's doing NOTHING to fix the problem," but as we've hinted at in other discussions... the Problem preceeds this administration by no less than a half-dozen decades, arguably four... maybe six Presidential Administrations, three generations and at least a hundred million willful voters (give or take). This administration is just a more glaring and offensive representation of the status quo we've all tried to ignore for so long. But yeah, the rate of change has definitely become measurable, and depending on the chart... exponential. And just in case anyone was wondering: Dear Senator Paul, On February 20, 2013, you write to John Brennan requesting additional information concerning the administration's views about whether "the President has the power to authorize lethal force, such as a drone strike, against a U.S. citizen on U.S. soil, and without trial." As members of this Administration have previously indicated, the US government has not carried out drone strikes in the United States and have no intention of doing so. As a policy matter, moreover, we reject the use of military force where well-established law enforcement authorities in this country provide the best means for incapacitating a terrorist threat. We have a long history of using the criminal justice system to incapacitate individuals located in our country who pose a threat to the United States and its interests abroad. Hundreds of individual have been arrested and convicted of terrorism-related offenses in our federal courts. The question you have posed is entirely hypothetical, unlikely to occur and we hope no president will ever have to confront. It is possible, I suppose, to imagine an extraordinary circumstance in which it would be necessary and appropriate under the Constitution and applicable laws of the United States for the President to authorize the military to use lethal force within the territory of the United States. For example, the president could conceivably have no choice but to authorize the military to use such force if necessary to protect the homeland in the circumstances of a catastrophic attack like the ones suffered on Dec. 7, 1941 and Sept. 11, 2001. Were such an emergency to arise, I would examine the particular facts and circumstances before advising the President on the scope of his authority. Sincerely, Eric Holder, Attorney General http://www.zerohedge.com/news/2013-03-05/dear-american-its-extraordinary-circumstance-and-drones-coming-you I'll be watching the news all week, waiting for the outrage.    "Fluency in English is something that I'm often not accused of."-George H.W. Bush "It depends on what the meaning of the words 'is' is." –Bill Clinton "I'll be long gone before some smart person ever figures out what happened inside this Oval Office." -George W. Bush Fanboy, 'Hey Mr. President, what is your definition of a terrorist?' Obama, 'Uuuuuuhhhhhh...I would like to quote my predecessors...' I've always been uncomfortable with the term "Homeland", defense of the "Homeland", "Department of Homeland Security". "Homeland", "fatherland", and "motherland", are just a little too unamerican for me. To me being an American was about "We the people...", the individual. |

|

|

|

Quoted:

...snip... Not sure if you're just reflecting on the data points I posted, or if there is a broader political innuendo there. But I'll just add this: There's plenty of blame to go `round, but I really can't get on the Anti-Bama Band Wagon too much. Sure, I can say "He's a part of the problem - and he's doing NOTHING to fix the problem," but as we've hinted at in other discussions... the Problem preceeds this administration by no less than a half-dozen decades, arguably four... maybe six Presidential Administrations, three generations and at least a hundred million willful voters (give or take). This administration is just a more glaring and offensive representation of the status quo we've all tried to ignore for so long. But yeah, the rate of change has definitely become measurable, and depending on the chart... exponential. And just in case anyone was wondering: Dear Senator Paul, ... I'll be watching the news all week, waiting for the outrage. My response was rooted in cynicism wrt Hope and Change. I fully realize that the responsibility for our current situation does not lie solely with the Obama administration regardless of however much I might wish for a return to the spending and deficit levels of even a decade ago. I am appalled at the lack of leadership from Congress. The best our president will do is agitate. Is there anyone in Washington who will make some hard decisions, rooted in constitutional liberty? The letter you quote is another confirmation of my fear. |

|

|

|

Just FYI, Rush just played on the radio the audio of Sen. Ted Cruz getting Holder to admit on record, that it would be unconstitutional to use a drone to kill and American on US soil that didnt pose or was not actively engaged in a physical threat...... for what its worth. Holder did NOT sound happy to admit it on record.

|

|

|

|

The OFFICIAL GET OUT OF JAIL FREE card:

...."concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them," since, "it will have a negative impact on the national economy, perhaps even the world economy," From here There you have it. Signed, sealed and delivered. Officially too big to prosecute. |

|

|

|

Meh, can't fire no one anyhow .... I mean, what would they do then ...

|

|

|

|

Quoted: Looks more like, "They hold the ball, the field, the score board and the referee."The OFFICIAL GET OUT OF JAIL FREE card: ...."concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them," since, "it will have a negative impact on the national economy, perhaps even the world economy," From here There you have it. Signed, sealed and delivered. Officially too big to prosecute. How come Holder hasn't been brought up on charges yet? Oh, yeah, he has the same advantage in another ball park, down the hill, on the same street. |

|

|

|

Quoted: You're not the only one, and your smart keeping productive employees employed, even while margins continue to shrink.Meh, can't fire no one anyhow .... I mean, what would they do then ...  Sales Look Good, but Profits 'stink'... Things will rebound on the 'Mom & Pop' level quicker once 'It' happens, and consistency will be rewarded generously. |

|

|

|

Quoted: I'll chime in and say that's the same way with my business. I'm busy as hell but I can't seem to get any meaningful profit. It has me exceptionally worried should things get slow.Quoted: You're not the only one, and your smart keeping productive employees employed, even while margins continue to shrink.Meh, can't fire no one anyhow .... I mean, what would they do then ...  Sales Look Good, but Profits 'stink'... Things will rebound on the 'Mom & Pop' level quicker once 'It' happens, and consistency will be rewarded generously. |

|

|

|

Quoted:

The OFFICIAL GET OUT OF JAIL FREE card: ...."concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them," since, "it will have a negative impact on the national economy, perhaps even the world economy," From here There you have it. Signed, sealed and delivered. Officially too big to prosecute. Cross off another one in the check list to becoming a banana republic |

|

|

|

Quoted: Quoted: The OFFICIAL GET OUT OF JAIL FREE card: ...."concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them," since, "it will have a negative impact on the national economy, perhaps even the world economy," From here There you have it. Signed, sealed and delivered. Officially too big to prosecute. Cross off another one in the check list to becoming a banana republic We've been travelling down this detour from the road of liberty for quite some time. The roadside attractions are just becoming more surreal as we go. |

|

|

|

Quoted:

We've been travelling down this road for quite some time. The roadside attractions of the surreal are simply becoming more obvious now. What really concerns me is that they don't even try to hide it now, it is out in the open and they don't care. In the past the media/journalists would have kept this in the shadows, now they are the mouth piece of the politburo. |

|

|

|

Quoted:

Quoted:

We've been travelling down this road for quite some time. The roadside attractions of the surreal are simply becoming more obvious now. What really concerns me is that they don't even try to hide it now, it is out in the open and they don't care. In the past the media/journalists would have kept this in the shadows, now they are the mouth piece of the politburo. Yep ... now where is that manuscript for my book ... I gotta get back on it in earnest. |

|

|

|

Quoted: Quoted: I'll chime in and say that's the same way with my business. I'm busy as hell but I can't seem to get any meaningful profit. It has me exceptionally worried should things get slow.Quoted: You're not the only one, and your smart keeping productive employees employed, even while margins continue to shrink.Meh, can't fire no one anyhow .... I mean, what would they do then ...  Sales Look Good, but Profits 'stink'... Things will rebound on the 'Mom & Pop' level quicker once 'It' happens, and consistency will be rewarded generously. Keep it up, be consistent, don't get to comfortable and don't worry to much...Your making it happen already; 99% of most Business owners are feeling the same pressures, no matter the type. Staying mentally Strong is more important than 'Financially' right now, keeping things in perspective. |

|

|

|

I remember back in the 90's, especially the late 90's, as China's negotiations to enter the WTO where really heating up, we all laughed at their economic data. To say they "massaged" their economic numbers was an understatement. Today, I feel the same way about our economic data. The CPI is my main concern. I believe its understated, which skews everything. Since it's understated our real GDP is overstated, and because our real GDP is overstated our ratio of Debt to GDP is understated. Our employment numbers seem to indicate millions of working age individuals have just...gone "Galt". They just aren't counted anymore. The widely reported unemployment number U3 is useless, labor participation seems to indicate that we've not moved the needle with literally 50 years worth of stimulus pushed into a 5 year period of time.

I swear I don't believe in conspiracies but the business media seems to be spinning (HARD) the silver lining to these economic dark clouds. Which really has me a little nervous. Not the "silver lining" so to speak, but the fact they seem to be trying to exaggerate it so hard. The global economy is on massive life-support (monetary intervention), and it just doesn't seem to be coming out of it. Not really. With all the stimulus governments and central banks have pumped into the market you'd expect them to be bouncing off the walls at this point, and they're just not. Still, equities are on an up-trend, bonds are flat (artificially maintained of course) but metals which are still on a down-trend haven't given up as much as I would have expected. This is a dangerous market to swim in, lots of chop. You really have to keep your wits about you. |

|

|

|

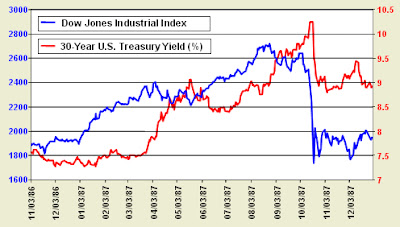

Stock Run Will End Badly This Year... He sees two possible scenarios. Either a 20 percent correction for stocks and then a move higher, or a scenario that is similar to 1987 or 2000 when stocks rise strongly early in the year only to drop sharply. 1987:  2000:   eta   |

|

|

|

Quoted: http://static.cdn-seekingalpha.com/uploads/2012/5/11/saupload_untitled_8.png On that big spike down day, I was one of two equities guys sitting on a bond trading desk. It was pandemonium. The money market groups were having kittens trying to keep a $1.00 par value. As an equities guy, it was interesting (and, I'm ashamed to say, somewhat humorous). On that day, I had absolutely no fear of any long term damage. The stocks that melted down were all going to continue to create value for shareholders in the coming months, and the economy was still reasonably strong. I was on the phone all day telling people to hang tight, and that 2-3 days from that moment, we were all going to go on a buying spree (and we did - client returns for the next 5 years were fantastic). That event was just a panic. None of the same foundations will apply to the next, seemingly inevitable event. October 19, 1987 I remember it well. Fast, violent, and short lived. By the end of December of that same year we were back. But that got me to thinking about the interest rate environment.

If that doesn't give you nightmares I don't know what will... |

||||||||||||||||||||||||||||

|

|

|

Quoted:

Quoted:

http://static.cdn-seekingalpha.com/uploads/2012/5/11/saupload_untitled_8.png On that big spike down day, I was one of two equities guys sitting on a bond trading desk. It was pandemonium. The money market groups were having kittens trying to keep a $1.00 par value. As an equities guy, it was interesting (and, I'm ashamed to say, somewhat humorous). On that day, I had absolutely no fear of any long term damage. The stocks that melted down were all going to continue to create value for shareholders in the coming months, and the economy was still reasonably strong. I was on the phone all day telling people to hang tight, and that 2-3 days from that moment, we were all going to go on a buying spree (and we did - client returns for the next 5 years were fantastic). That event was just a panic. None of the same foundations will apply to the next, seemingly inevitable event. October 19, 1987 I remember it well. Fast, violent, and short lived. By the end of December of that same year we were back. But that got me to thinking about the interest rate environment.

If that doesn't give you nightmares I don't know what will... By the time Treasury yields hit about 7%, we're done. The .gov could not make the interest payments and still continue to function. By 14%, the .gov would be paying out more in interest payments than what it is taking in in total tax revenue. At that point, we're Zimbabwe. Keep in mind that those rates are within many of our memories, so it's not like back some generations ago time our ancestors had to deal with. And still the pols in DC seem to want to keep either kicking the can down the road (Repubs) or INCREASE our deficit spending/debt death spiral (the Omarxist-in-thief).

|

||||||||||||||||||||||||||||

|

|

Win a FREE Membership!

Win a FREE Membership!

Sign up for the ARFCOM weekly newsletter and be entered to win a free ARFCOM membership. One new winner* is announced every week!

You will receive an email every Friday morning featuring the latest chatter from the hottest topics, breaking news surrounding legislation, as well as exclusive deals only available to ARFCOM email subscribers.

AR15.COM is the world's largest firearm community and is a gathering place for firearm enthusiasts of all types.

From hunters and military members, to competition shooters and general firearm enthusiasts, we welcome anyone who values and respects the way of the firearm.

Subscribe to our monthly Newsletter to receive firearm news, product discounts from your favorite Industry Partners, and more.

Copyright © 1996-2024 AR15.COM LLC. All Rights Reserved.

Any use of this content without express written consent is prohibited.

AR15.Com reserves the right to overwrite or replace any affiliate, commercial, or monetizable links, posted by users, with our own.