|

Quoted: I think it will be back in the mid 700 range in short order, maybe by tomorrow EOB View Quote View All Quotes View All Quotes Quoted: Quoted: Quoted: And that makes it go down 2.85%? It's up after hours after they released the report. But the market is fickle. It might not have been a big enough beat.  I think it will be back in the mid 700 range in short order, maybe by tomorrow EOB It obviously exceeded my expectations, made some damn good money on this run |

|

|

|

Quoted: Did you buy and sell just today? Impressive. Or were they shares you already had? I have some shares, ain’t selling. They were bought at various times last year. View Quote Bought ‘em a long time ago. Idk how many times it’s split since then, but would have been the equivalent of like $38/share. |

|

|

|

Every time I think of buying more, I always talk myself out of it.

"It's going to collapse soon, don't want to buy when it's this high" ...then it just keeps going higher and higher.

|

|

|

|

|

|

|

|

Quoted: Every time I think of buying more, I always talk myself out of it. "It's going to collapse soon, don't want to buy when it's this high" ...then it just keeps going higher and higher.  View Quote Hindsight is a bitch isn’t it? I have some. Not a lot, but some. I’m just going to hold dat shit. Muh p/e! Then I remind myself stock price is just supply/demand. With fixed supply. |

|

|

|

Quoted: If only you had kept what you sold last year...  View Quote View All Quotes View All Quotes Quoted: Quoted: Every time I think of buying more, I always talk myself out of it. "It's going to collapse soon, don't want to buy when it's this high" ...then it just keeps going higher and higher.  If only you had kept what you sold last year...  I had 100 shares that I bought around $265 in November of 2021, took profits by selling it at about $424 late last year. Bought back in with 75 shares around $504. So I'm still in the game, albeit with less than if I'd just left it in the market.  Lesson learned. On the other hand, I'm up >80% on what I bought at $500/share. Lesson learned. On the other hand, I'm up >80% on what I bought at $500/share.Mostly I'm considering grabbing another 25 shares so I have an even 100 shares. But each time I think about it...NVDA just keeps getting more and more expensive.  "Surely it will drop any day now..." "Surely it will drop any day now..."

|

|

|

|

Quoted: I had 100 shares that I bought around $265 in November of 2021, took profits by selling it at about $424 late last year. Bought back in with 75 shares around $504. So I'm still in the game, albeit with less than if I'd just left it in the market.  Lesson learned. On the other hand, I'm up >80% on what I bought at $500/share. Lesson learned. On the other hand, I'm up >80% on what I bought at $500/share.Mostly I'm considering grabbing another 25 shares so I have an even 100 shares. But each time I think about it...NVDA just keeps getting more and more expensive.  "Surely it will drop any day now..." "Surely it will drop any day now..."View Quote View All Quotes View All Quotes Quoted: Quoted: Quoted: Every time I think of buying more, I always talk myself out of it. "It's going to collapse soon, don't want to buy when it's this high" ...then it just keeps going higher and higher.  If only you had kept what you sold last year...  I had 100 shares that I bought around $265 in November of 2021, took profits by selling it at about $424 late last year. Bought back in with 75 shares around $504. So I'm still in the game, albeit with less than if I'd just left it in the market.  Lesson learned. On the other hand, I'm up >80% on what I bought at $500/share. Lesson learned. On the other hand, I'm up >80% on what I bought at $500/share.Mostly I'm considering grabbing another 25 shares so I have an even 100 shares. But each time I think about it...NVDA just keeps getting more and more expensive.  "Surely it will drop any day now..." "Surely it will drop any day now..."Everybody is looking for the next big tech advancement, hence the demand. I sold some aapl way back because it was dominating my holdings in value. Biggest mistake I ever made. You fucking hold the rockstars long term. I’m still about 35% aapl. Ain’t scared, ain’t selling even though it’s been underperforming lately. I just have to stick to my long term outlook. Honestly when my bonus comes in I may just toss it all on nvidia and see what happens in 10 years. No risk, no reward. My risk tolerance is high. |

|

|

|

Quoted: I had 100 shares that I bought around $265 in November of 2021, took profits by selling it at about $424 late last year. Bought back in with 75 shares around $504. So I'm still in the game, albeit with less than if I'd just left it in the market.  Lesson learned. On the other hand, I'm up >80% on what I bought at $500/share. Lesson learned. On the other hand, I'm up >80% on what I bought at $500/share.Mostly I'm considering grabbing another 25 shares so I have an even 100 shares. But each time I think about it...NVDA just keeps getting more and more expensive.  "Surely it will drop any day now..." "Surely it will drop any day now..."View Quote Yeah, I've been in and out of it along the way. Still have about 7% in a couple of my accounts. At one point I had about 20% for a short time but I got worried at the end of every day's session.

|

|

|

|

I'm ruined.

We haven't seen these low prices since...2 days ago. |

|

|

|

Quoted: Every time I think of buying more, I always talk myself out of it. "It's going to collapse soon, don't want to buy when it's this high" ...then it just keeps going higher and higher.  View Quote LOL this. Looks like it's started to come back down after the hype. Maybe after the split. I just don't know, they have some competitors coming in to the AI chip market with some very impressive sounding chips. |

|

|

|

|

|

Quoted: LOL this. Looks like it's started to come back down after the hype. Maybe after the split. I just don't know, they have some competitors coming in to the AI chip market with some very impressive sounding chips. View Quote View All Quotes View All Quotes Quoted: Quoted: Every time I think of buying more, I always talk myself out of it. "It's going to collapse soon, don't want to buy when it's this high" ...then it just keeps going higher and higher.  LOL this. Looks like it's started to come back down after the hype. Maybe after the split. I just don't know, they have some competitors coming in to the AI chip market with some very impressive sounding chips. But can those competitors scale production like nvidia can? I don’t know much about semiconduct Manufacturing, only that it takes a ton of capital investment to do so and is constantly evolving/improving. Nvidia has been doing this for a long time and are very innovative. Look at what Apple did making their own chips, it propelled them to a very real and big competitive advantage. Same with Cisco and their custom ASICs. Nvidia core business model is making hardcore silicon. And they’re good at it. I’m a EE and work in IT. What nvidia is doing is amazing. Intel has been sleeping, not innovating. They’ve become IBM. |

|

|

|

Quoted: But can those competitors scale production like nvidia can? I don’t know much about semiconduct Manufacturing, only that it takes a ton of capital investment to do so and is constantly evolving/improving. Nvidia has been doing this for a long time and are very innovative. Look at what Apple did making their own chips, it propelled them to a very real and big competitive advantage. Same with Cisco and their custom ASICs. Nvidia core business model is making hardcore silicon. And they’re good at it. I’m a EE and work in IT. What nvidia is doing is amazing. Intel has been sleeping, not innovating. They’ve become IBM. View Quote View All Quotes View All Quotes Quoted: Quoted: Quoted: Every time I think of buying more, I always talk myself out of it. "It's going to collapse soon, don't want to buy when it's this high" ...then it just keeps going higher and higher.  LOL this. Looks like it's started to come back down after the hype. Maybe after the split. I just don't know, they have some competitors coming in to the AI chip market with some very impressive sounding chips. But can those competitors scale production like nvidia can? I don’t know much about semiconduct Manufacturing, only that it takes a ton of capital investment to do so and is constantly evolving/improving. Nvidia has been doing this for a long time and are very innovative. Look at what Apple did making their own chips, it propelled them to a very real and big competitive advantage. Same with Cisco and their custom ASICs. Nvidia core business model is making hardcore silicon. And they’re good at it. I’m a EE and work in IT. What nvidia is doing is amazing. Intel has been sleeping, not innovating. They’ve become IBM. The thing I think people miss with semi conductors, is that they are consumables. If you compete in the high speed data center space, you have to get the latest and greatest fast chips or your competitors will run you over. Mobile devices end up driving a lot of development. There's a 12 month cadence for chip designs so they can get to apple and samsung to make deliveries in time for the phone launches. All other devices timelines sort of end up following this cycle. It's also what makes semis so cyclical - it's feast or famine depensing on industry needs. Layoffs in 2019, meteoric runs in 2020 to meet demand. Now, memory manufacturers built up a glut following covid and they didn't cut back until it was too late and built up a big supply that has finally drawn down. I think the next couple years the chip makers that supply companies like nvidia are about to go bananas. Less supply means they can charge higher prices. |

|

|

|

Quoted: The thing I think people miss with semi conductors, is that they are consumables. If you compete in the high speed data center space, you have to get the latest and greatest fast chips or your competitors will run you over. Mobile devices end up driving a lot of development. There's a 12 month cadence for chip designs so they can get to apple and samsung to make deliveries in time for the phone launches. All other devices timelines sort of end up following this cycle. It's also what makes semis so cyclical - it's feast or famine depensing on industry needs. Layoffs in 2019, meteoric runs in 2020 to meet demand. Now, memory manufacturers built up a glut following covid and they didn't cut back until it was too late and built up a big supply that has finally drawn down. I think the next couple years the chip makers that supply companies like nvidia are about to go bananas. Less supply means they can charge higher prices. View Quote View All Quotes View All Quotes Quoted: Quoted: Quoted: Quoted: Every time I think of buying more, I always talk myself out of it. "It's going to collapse soon, don't want to buy when it's this high" ...then it just keeps going higher and higher.  LOL this. Looks like it's started to come back down after the hype. Maybe after the split. I just don't know, they have some competitors coming in to the AI chip market with some very impressive sounding chips. But can those competitors scale production like nvidia can? I don’t know much about semiconduct Manufacturing, only that it takes a ton of capital investment to do so and is constantly evolving/improving. Nvidia has been doing this for a long time and are very innovative. Look at what Apple did making their own chips, it propelled them to a very real and big competitive advantage. Same with Cisco and their custom ASICs. Nvidia core business model is making hardcore silicon. And they’re good at it. I’m a EE and work in IT. What nvidia is doing is amazing. Intel has been sleeping, not innovating. They’ve become IBM. The thing I think people miss with semi conductors, is that they are consumables. If you compete in the high speed data center space, you have to get the latest and greatest fast chips or your competitors will run you over. Mobile devices end up driving a lot of development. There's a 12 month cadence for chip designs so they can get to apple and samsung to make deliveries in time for the phone launches. All other devices timelines sort of end up following this cycle. It's also what makes semis so cyclical - it's feast or famine depensing on industry needs. Layoffs in 2019, meteoric runs in 2020 to meet demand. Now, memory manufacturers built up a glut following covid and they didn't cut back until it was too late and built up a big supply that has finally drawn down. I think the next couple years the chip makers that supply companies like nvidia are about to go bananas. Less supply means they can charge higher prices. I just read a lengthy article about nvidia business model. Can’t find the link. At their core, they make GPUs. It just so happens that their innovative chip designs make those GPUs incredibly good at other things. Like AI, etc. hardware is always faster than software. By a scale of 50-10000. They are deep in the automotive field, self driving cars, etc. The fact the founder is still the ceo and primary individual shareholder at 4% is a plus. Skin in the game and a visionary leader. After my dilligence I’d rate this a buy/hold. Even at this price. Competitors are intel (yawn) and AMD (meh). That’s not their lane, GPUs. Their lane is CPUs. And they are very good at that. For the ankle biters promising chips better than what nvidia has been doing for decades? I’ll wait to see if they can deliver a better mouse trap. I don’t think they have the capital nor capacity to do so. |

|

|

|

Quoted: But can those competitors scale production like nvidia can? I don’t know much about semiconduct Manufacturing, only that it takes a ton of capital investment to do so and is constantly evolving/improving. Nvidia has been doing this for a long time and are very innovative. Look at what Apple did making their own chips, it propelled them to a very real and big competitive advantage. Same with Cisco and their custom ASICs. Nvidia core business model is making hardcore silicon. And they’re good at it. I’m a EE and work in IT. What nvidia is doing is amazing. Intel has been sleeping, not innovating. They’ve become IBM. View Quote I'm assuming they could scale pretty quick. Groq and Cerebras secured large funds, and manufacturers like Nvidia and AMD do not manufacture their GPUs and CPUs themselves, companies like TSMC do. They could even outsource board manufacture to a companies like Asus. ETA: Before reading about these newcomers I would have said Nvidia would be a sure thing for investment. Now I'm not so sure. |

|

|

|

Quoted: I'm assuming they could scale pretty quick. Groq and Cerebras secured large funds, and manufacturers like Nvidia and AMD do not manufacture their GPUs and CPUs themselves, companies like TSMC do. They could even outsource board manufacture to a companies like Asus. ETA: Before reading about these newcomers I would have said Nvidia would be a sure thing for investment. Now I'm not so sure. View Quote View All Quotes View All Quotes Quoted: Quoted: But can those competitors scale production like nvidia can? I don’t know much about semiconduct Manufacturing, only that it takes a ton of capital investment to do so and is constantly evolving/improving. Nvidia has been doing this for a long time and are very innovative. Look at what Apple did making their own chips, it propelled them to a very real and big competitive advantage. Same with Cisco and their custom ASICs. Nvidia core business model is making hardcore silicon. And they’re good at it. I’m a EE and work in IT. What nvidia is doing is amazing. Intel has been sleeping, not innovating. They’ve become IBM. I'm assuming they could scale pretty quick. Groq and Cerebras secured large funds, and manufacturers like Nvidia and AMD do not manufacture their GPUs and CPUs themselves, companies like TSMC do. They could even outsource board manufacture to a companies like Asus. ETA: Before reading about these newcomers I would have said Nvidia would be a sure thing for investment. Now I'm not so sure. The new comers are going get a ton of capital. It’s the “next big thing”. Slap AI on anything and people throw money at you. How to seperate the marketing chaf from the wheat will be difficult. Can they execute is the question. I’ll side with a proven leader in their industry. Nvidia. AMD and intel slept on this market “it’s just gamers, there’s no future in that”. |

|

|

|

Quoted: I'm assuming they could scale pretty quick. Groq and Cerebras secured large funds, and manufacturers like Nvidia and AMD do not manufacture their GPUs and CPUs themselves, companies like TSMC do. They could even outsource board manufacture to a companies like Asus. ETA: Before reading about these newcomers I would have said Nvidia would be a sure thing for investment. Now I'm not so sure. View Quote View All Quotes View All Quotes Quoted: Quoted: But can those competitors scale production like nvidia can? I don’t know much about semiconduct Manufacturing, only that it takes a ton of capital investment to do so and is constantly evolving/improving. Nvidia has been doing this for a long time and are very innovative. Look at what Apple did making their own chips, it propelled them to a very real and big competitive advantage. Same with Cisco and their custom ASICs. Nvidia core business model is making hardcore silicon. And they’re good at it. I’m a EE and work in IT. What nvidia is doing is amazing. Intel has been sleeping, not innovating. They’ve become IBM. I'm assuming they could scale pretty quick. Groq and Cerebras secured large funds, and manufacturers like Nvidia and AMD do not manufacture their GPUs and CPUs themselves, companies like TSMC do. They could even outsource board manufacture to a companies like Asus. ETA: Before reading about these newcomers I would have said Nvidia would be a sure thing for investment. Now I'm not so sure. TSMC also has a large target on it right now from the mainland. |

|

|

|

Quoted: TSMC also has a large target on it right now from the mainland. View Quote View All Quotes View All Quotes Quoted: Quoted: Quoted: But can those competitors scale production like nvidia can? I don’t know much about semiconduct Manufacturing, only that it takes a ton of capital investment to do so and is constantly evolving/improving. Nvidia has been doing this for a long time and are very innovative. Look at what Apple did making their own chips, it propelled them to a very real and big competitive advantage. Same with Cisco and their custom ASICs. Nvidia core business model is making hardcore silicon. And they’re good at it. I’m a EE and work in IT. What nvidia is doing is amazing. Intel has been sleeping, not innovating. They’ve become IBM. I'm assuming they could scale pretty quick. Groq and Cerebras secured large funds, and manufacturers like Nvidia and AMD do not manufacture their GPUs and CPUs themselves, companies like TSMC do. They could even outsource board manufacture to a companies like Asus. ETA: Before reading about these newcomers I would have said Nvidia would be a sure thing for investment. Now I'm not so sure. TSMC also has a large target on it right now from the mainland. Whoa, I didn't even think of that... I have thought earlier that it would be huge if China took TSMC, as if I recall at the time they didn't have much competition at least at whatever nanometer process at the time. With how big AI looks to change things, now with weak-ass Biden in office for possibly only 1 more year and our distraction over in Ukraine now 2024 would be the time for them to make a move. We're still years from fabbing that sort of tech here. Their biggest problem would be to make sure TSMC and essential personell are not harmed. |

|

|

|

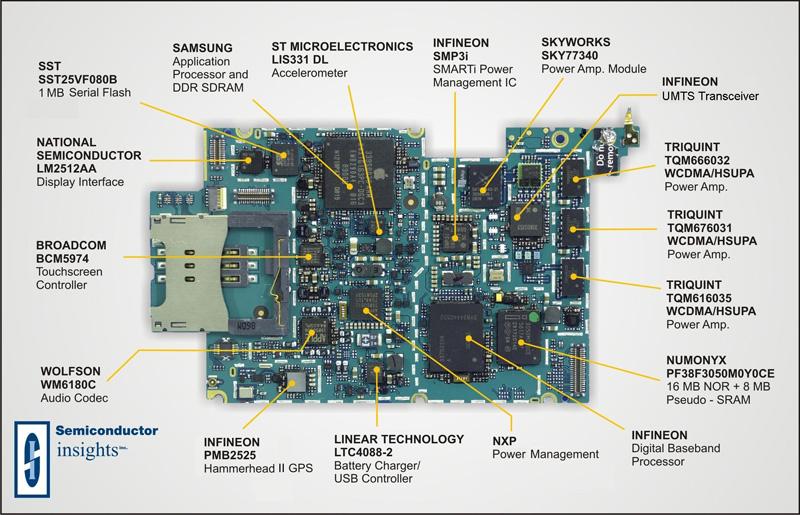

Quoted: I just read a lengthy article about nvidia business model. Can’t find the link. At their core, they make GPUs. It just so happens that their innovative chip designs make those GPUs incredibly good at other things. Like AI, etc. hardware is always faster than software. By a scale of 50-10000. They are deep in the automotive field, self driving cars, etc. The fact the founder is still the ceo and primary individual shareholder at 4% is a plus. Skin in the game and a visionary leader. After my dilligence I’d rate this a buy/hold. Even at this price. Competitors are intel (yawn) and AMD (meh). That’s not their lane, GPUs. Their lane is CPUs. And they are very good at that. For the ankle biters promising chips better than what nvidia has been doing for decades? I’ll wait to see if they can deliver a better mouse trap. I don’t think they have the capital nor capacity to do so. View Quote View All Quotes View All Quotes Quoted: Quoted: Quoted: Quoted: Quoted: Every time I think of buying more, I always talk myself out of it. "It's going to collapse soon, don't want to buy when it's this high" ...then it just keeps going higher and higher.  LOL this. Looks like it's started to come back down after the hype. Maybe after the split. I just don't know, they have some competitors coming in to the AI chip market with some very impressive sounding chips. But can those competitors scale production like nvidia can? I don’t know much about semiconduct Manufacturing, only that it takes a ton of capital investment to do so and is constantly evolving/improving. Nvidia has been doing this for a long time and are very innovative. Look at what Apple did making their own chips, it propelled them to a very real and big competitive advantage. Same with Cisco and their custom ASICs. Nvidia core business model is making hardcore silicon. And they’re good at it. I’m a EE and work in IT. What nvidia is doing is amazing. Intel has been sleeping, not innovating. They’ve become IBM. The thing I think people miss with semi conductors, is that they are consumables. If you compete in the high speed data center space, you have to get the latest and greatest fast chips or your competitors will run you over. Mobile devices end up driving a lot of development. There's a 12 month cadence for chip designs so they can get to apple and samsung to make deliveries in time for the phone launches. All other devices timelines sort of end up following this cycle. It's also what makes semis so cyclical - it's feast or famine depensing on industry needs. Layoffs in 2019, meteoric runs in 2020 to meet demand. Now, memory manufacturers built up a glut following covid and they didn't cut back until it was too late and built up a big supply that has finally drawn down. I think the next couple years the chip makers that supply companies like nvidia are about to go bananas. Less supply means they can charge higher prices. I just read a lengthy article about nvidia business model. Can’t find the link. At their core, they make GPUs. It just so happens that their innovative chip designs make those GPUs incredibly good at other things. Like AI, etc. hardware is always faster than software. By a scale of 50-10000. They are deep in the automotive field, self driving cars, etc. The fact the founder is still the ceo and primary individual shareholder at 4% is a plus. Skin in the game and a visionary leader. After my dilligence I’d rate this a buy/hold. Even at this price. Competitors are intel (yawn) and AMD (meh). That’s not their lane, GPUs. Their lane is CPUs. And they are very good at that. For the ankle biters promising chips better than what nvidia has been doing for decades? I’ll wait to see if they can deliver a better mouse trap. I don’t think they have the capital nor capacity to do so. I think maybe my explanation wasn't great. There's an illustration of an Nvidia GPU showing something similar but I can't find it. So I'll just illustrate with this. An Iphone 3. This is all the way back in 2008. My point is that in order for Apple to build an iPhone there are a whole bunch of players that have to contribute. Broadcom, Infineon, NXP, and Skyworks are all publicly traded companies noted here. Oh yeah and there's Samsung. And you might think well that's a little weird, but apple makes their own chips now. Right? Well kind of. The processor they do, and some other components but they don't make everything, even today. 2022 2023. Shit some components are probably still coming from Samsung.  And this is what I'm trying to get at with Nvidia. They design their architecture but they don't make the whole thing - specifically to my previous post - they might make the GPU but they don't make memory; Samsung, TSMC, Micron, and Sk Hynix do. And their has been a massive oversupply of memory from Covid demand that is only now bottoming out. Basic economics just says that as the supply surplus runs out it stops being cheap. I don't have a lot of confidence in Intel's long term future. Intel NEEDS compute to stay on the CPU but I've seen the efforts of moving compute closer to memory (see the hybrid memory cube) and the tech is wicked. But Intel is still the Gorilla in the room, and when it comes time to define the spec for new technology, compute that moves away from the CPU is a threat to Intel's business model. The less a CPU is needed, the less demand there is for Intel. So they bully everyone else into compliance when it comes to standards to keep compute on the CPU. But Intel's blunders might just do them in. They've started making video cards which I personally see as a bit desperate at this point but maybe they will catch up. Their jump to EUV was incredibly pre-mature. Nvidia might just render them worthless. At some point during the process of defining standards for whatever generation of tech, Nvidia could see Intel weak enough and decide to go to war, move compute further away from the CPU and at that point it's a slow death for Intel unless they really figure something out. AMD has been in the shadow of Intel and I just see that continuing. But they do make GPUs so I guess they have that going for them. |

|

|

|

I still wished I could have bought some at the IPO, but I could barely afford the riva 128 I think I had. Interesting that 3dfx had the better initial product and is gone.

|

|

|

|

I thought I was doing well with NVDA, being up 2200%. Until my friend showed me the crypto shitcoin he invested $350 in a couple months ago, and now it's worth somewhere around $140k. He's got diamond hands. Who knew Dog Wif Hat would be a solid investment? It's got a market cap bigger than Office Depot and Frontier Airlines. https://coinmarketcap.com/currencies/dogwifhat/ |

|

|

|

Up 7% today. Not bad. Had a nice run the last 20 minutes of the day.

|

|

|

|

Anyone following/attending GTC?

Nvidia is doing a lot of interesting stuff but seems to be extremely stretched and near the breaking point. Blackwell is just low FP SM spam to reticle limits. I'm guessing they weren't happy to get pushed off N3P in '24. So the expected next step is getting basically the same architecture on N3P/N3X and going quad +800mm2 die for N100 to try and ship in 1H '25 to have the chance of competing with MI400. Think that explains why Jensen was so adamant about Blackwell being the name of the platform and not the specific chip. AMD is expected to gobbled up ~10% of the AI marketshare this year with MI300/x, potentially upwards of 15%. Not to mention a handful of AI startups plan to release/ship their own in-house designs throughout the next 12-18months, adding even more competitors. The curve on Nvidia's AI bubble appears to be flattening out. |

|

|

|

@Spidey07 This is what I'm talking about. Micron’s stock rockets higher as company delivers big, AI-fueled earnings beat

Nvidia is buying Micron chips, and others like from Sk Hynix, Samsung, and TSMC. But, Nvidia HAS TO HAVE THEM to build their GPUs. The supply of those chips have dwindled. Micron said the entire year of supply has been accounted for, and most of 2025 chips have been bought - per the earnings report today.  And as I said before today's earnings report... semiconductors are going to fucking RUN. This is a new all time high for Micron. The big boys need these companies to build these kinds of chips to integrate them into the ones they make. What happens when supply falls and demand keeps ripping higher? These supplementary chip makers make money. And if Nvidia wants to continue to buy these chips they will have to pay more for them. And at some point I think that will cut into their earnings. I don't know about all of them but TSMC at least doesn't report earnings for a couple more weeks... |

|

|

|

Quoted: @Spidey07 This is what I'm talking about. Micron’s stock rockets higher as company delivers big, AI-fueled earnings beat Nvidia is buying Micron chips, and others like from Sk Hynix, Samsung, and TSMC. But, Nvidia HAS TO HAVE THEM to build their GPUs. The supply of those chips have dwindled. Micron said the entire year of supply has been accounted for, and most of 2025 chips have been bought - per the earnings report today. https://imgur.com/P6pvvnz.jpg And as I said before today's earnings report... semiconductors are going to fucking RUN. This is a new all time high for Micron. The big boys need these companies to build these kinds of chips to integrate them into the ones they make. What happens when supply falls and demand keeps ripping higher? These supplementary chip makers make money. And if Nvidia wants to continue to buy these chips they will have to pay more for them. And at some point I think that will cut into their earnings. I don't know about all of them but TSMC at least doesn't report earnings for a couple more weeks... View Quote I see. So do you consider that core supply chain for nvidia? What other customers do those suppliers serve? If micron got hit by a bus, could nvidia still produce? I thought nvidia strength was its chips/design. |

|

|

Win a FREE Membership!

Win a FREE Membership!

Sign up for the ARFCOM weekly newsletter and be entered to win a free ARFCOM membership. One new winner* is announced every week!

You will receive an email every Friday morning featuring the latest chatter from the hottest topics, breaking news surrounding legislation, as well as exclusive deals only available to ARFCOM email subscribers.

AR15.COM is the world's largest firearm community and is a gathering place for firearm enthusiasts of all types.

From hunters and military members, to competition shooters and general firearm enthusiasts, we welcome anyone who values and respects the way of the firearm.

Subscribe to our monthly Newsletter to receive firearm news, product discounts from your favorite Industry Partners, and more.

Copyright © 1996-2024 AR15.COM LLC. All Rights Reserved.

Any use of this content without express written consent is prohibited.

AR15.Com reserves the right to overwrite or replace any affiliate, commercial, or monetizable links, posted by users, with our own.