|

Picked up a little UPRO late this afternoon (the opposite of SPXU), pretty well nailed the day's low. I'm really liking the 3X ultra/inverse ETFs. Hoping tomorrow goes up a bit. I'm not planning on holding it past tomorrow. Next week is anyone's guess.

|

|

|

|

This Zerohedge posting is worth a read.

http://www.zerohedge.com/news/so-what-about-those-next-20-days This is what happens when the market prices in $1+ trillion in loose money from the Chairman, and gets a sharp stick in the eye instead.

(several charts) ...And beneath it is all is the creeping realization that the Fed's most recent global bailout action with the ECB, the SNB, the BOJ and the BOE does not start for another 20 days, or October 12, 2011. That's right: three weeks in which there is nothing in place to provide the much critical trillions of dollar that every bank in the world so desperately needs. |

|

|

|

Quoted: Quoted: -500 and counting Plunge team kicked in at the last moment but they could only bring it up around 100 points. Lots of red across the board. It'll go up tomorrow, you'll get some buy in's and gamblers but there is NOTHING that is realistic about the market anymore. I'm not even that sure about the lowered expectations for the Christmas season because a lot of people are finally figuring out that debt for presents is a stupid idea and any more debt [household debt] is just idiotic. The PPT doesn't have to work very hard if this is all it takes to change directions so quickly. Or was this the PPT at work?: http://www.zerohedge.com/news/euro-stocks-soar-ft-report-eu-looks-swift-recap-european-banks Euro, Stocks Soar On FT Report EU "Looks To Swift Recap" Of European Banks And right on cue, just like 2 weeks ago when the FT "broke" the news that China was about to bailout Europe (all over again), here they come again, reporting that the EU is "looking to [sic] swift recapitalzation of 16 banks." From the FT: :European officials look set to speed up plans to recapitalise the 16 banks that came close to failing last summer’s pan-EU stress tests as part of a co-ordinated effort to reassure the markets about the strength of the 27-nation bloc’s banking sector. A senior French official said the 16 banks regarded to be close to the threshold would now have to seek new funds immediately. Although there has been widespread speculation that French banks are seeking more capital, none is on the list. Other European officials said discussions were still under way. The move would affect mostly mid-tier banks. Seven are Spanish, two are from Germany, Greece and Portugal, and one each from Italy, Cyprus and Slovenia. The list includes Germany’s HSH Nordbank and Banco Popolare of Italy." And we are now taking bets on how long until this whole non-news, all rumor move is faded. Update: We answer our own question: 30 minutes. |

|

|

|

Bought a 09 Ford Super Duty for the new company today... sitting in the office waiting to sign the loan and.... oh look....

Dow down 400 points.  |

|

|

|

Gold breaks below $1700, silver flirting with $30 soon AND stock market taking a beating. This is usually an inverse relationship.

|

|

|

|

Quoted:

Gold breaks below $1700, silver flirting with $30 soon AND stock market taking a beating. This is usually an inverse relationship. Are we repeating Q3 of 2008? Similar pattern, equities tank, PMs follow (liquidity squeeze?) most commodities go down..... |

|

|

|

About to take delivery of the new road warrior machine.... prepare your anus for Dow -666 as punishment from Jesus for my lack of frugality.

|

|

|

|

Quoted:

About to take delivery of the new road warrior machine.... prepare your anus for Dow -666 as punishment from Jesus for my lack of frugality. Ditto, my Cummins-equipped jeep arrives today. |

|

|

|

Quoted:

Quoted:

About to take delivery of the new road warrior machine.... prepare your anus for Dow -666 as punishment from Jesus for my lack of frugality. Ditto, my Cummins-equipped jeep arrives today. I want pictures. This sounds badass. Posted Via AR15.Com Mobile |

|

|

|

Quoted: Serious question - Have the "bubbles" popped? The ultimate credit bubble popped in 2008. But central and investing banks and Governments have been blowing as hard as they can into the deflating balloon to prevent the inevitable and necessary bottom. They're now light headed and ready to collapse themselves... |

|

|

|

Quoted: I bought two hand guns and more reloading supplies/equipment in the last month and a half.Quoted: About to take delivery of the new road warrior machine.... prepare your anus for Dow -666 as punishment from Jesus for my lack of frugality. Ditto, my Cummins-equipped jeep arrives today. I've been frugal for more than a year now. No debt, and still have a lot wasting away in savings. |

|

|

|

Quoted: Quoted: About to take delivery of the new road warrior machine.... prepare your anus for Dow -666 as punishment from Jesus for my lack of frugality. Ditto, my Cummins-equipped jeep arrives today. |

|

|

|

Quoted: Quoted: I bought two hand guns and more reloading supplies/equipment in the last month and a half.Quoted: About to take delivery of the new road warrior machine.... prepare your anus for Dow -666 as punishment from Jesus for my lack of frugality. Ditto, my Cummins-equipped jeep arrives today. I've been frugal for more than a year now. No debt, and still have a lot wasting away in savings. Ive done mostly the same, with the exception of the reloading equipment. Saving and frugality allowed me leverage when purchasing this new vehicle for my company. Had I been living paycheck to paycheck I'd be hosed. Rings went on the Cummins and I had the cash, credit, and knowledge to move right into a very nice Ford with a minor change in debt load. It's almost like I'm walking the path to contractor hood along side the father and son in "The Road". Europe going tits up and America in full panic. Yet here I am, trying to still add more value to the economy and keep oil and natural gas flowing. Sometimes I wonder about myself.... No freeloading: China Pushes For More Stable Reserve Currency - Bye Bye USD?*CHINA SAYS IMF SHOULD STUDY DEFECTS OF WORLD MONETARY SYSTEM*CHINA SAYS IMF SHOULD DIVERSIFY GLOBAL RESERVE CURRENCIES *CHINA SEEKS `STABLE VALUE' IN RESERVE CURRENCY SYSTEM And in case anyone is still unsure of their commitment to slow growth: *CHINA WILL SEEK TO MANAGE INFLATION EXPECTATIONS, XIE SAYS http://www.zerohedge.com/news/china-pushes-more-stable-reserve-currency-bye-bye-usd |

|

|

|

Quoted:

Quoted:

I bought two hand guns and more reloading supplies/equipment in the last month and a half.

Quoted:

About to take delivery of the new road warrior machine.... prepare your anus for Dow -666 as punishment from Jesus for my lack of frugality. Ditto, my Cummins-equipped jeep arrives today. I've been frugal for more than a year now. No debt, and still have a lot wasting away in savings. I leave early monday am to go pick up a deuce and a half in WV. It'll be a long drive, at least I won't be able to listen to talk radio. |

|

|

|

Quoted:

Quoted:

Quoted:

About to take delivery of the new road warrior machine.... prepare your anus for Dow -666 as punishment from Jesus for my lack of frugality. Ditto, my Cummins-equipped jeep arrives today. I want pictures. This sounds badass. Posted Via AR15.Com Mobile I can't take no credit other than writing a relatively small check. |

|

|

|

A good summary of what is at stake with a Greek default and why the EU is desperate to stop or at least manage a default.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Greece on Edge of Insolvency 24 Centuries After City Default History’s first sovereign default came in the 4th century BC, committed by 10 Greek municipalities. There was one creditor: the temple of Delos, Apollo’s mythical birthplace. Twenty-four centuries later, Greece is at the edge of the biggest sovereign default and policy makers are worried about global shock waves of an insolvency by a government with 353 billion euros ($483 billion) of debt –– five times the size of Argentina’s $95 billion default in 2001. “There is a monstrously large amount of uncertainty and a massive range of possibilities,” said David Mackie, chief European economist at JPMorgan Chase & Co. in London. “A macroeconomic disaster could be averted but only by aggressive policy action” by central banks and governments, he said. After two international-bailout deals, three years of recession and budget-cutting votes that almost cost him his job, Greek Prime Minister George Papandreou says throwing in the towel now would be a “catastrophe.” Potential consequences of a national bankruptcy include the failure of the country’s banking system, an even deeper economic contraction and government collapse. The fallout may echo the days following the 2008 implosion of Lehman Brothers Holdings Inc. when credit markets froze and the global economy sank into recession, this time with the prospect that the 17-nation euro zone splinters before reaching its teens. The International Monetary Fund, whose annual meetings start in Washington today, reckons the debt crisis has generated as much as 300 billion euros in credit risk for European banks. Default Risk Greek two-year yields surged above 70 percent today and credit-insurance prices on Greece indicate the chance of default at more than 90 percent. Investors can expect losses on Greek debt of as much as 100 percent, says Mark Schofield, head of interest-rate strategy at Citigroup Inc. in London. “People, justifiably, think the crisis is what we’re living now: cuts in wages, pensions and incomes, fewer prospects for the young,” Greek Finance Minister Evangelos Venizelos told reporters yesterday in Athens. “Unfortunately this isn’t the crisis. This is an attempt, a difficult attempt, to protect ourselves and avert a crisis. Because the crisis is Argentina: the complete collapse of the economy, institutions, the social fabric and the productive base of the country.” Even if Greece receives its next aid payment, due next month, default beckons in December when 5.23 billion euros of bonds mature, said Harvinder Sian, senior interest rate strategist at Royal Bank of Scotland Group Plc. ‘Too Late’ “It’s too late for Greece,” Howard Davies, a former U.K. central banker and financial regulator, told “Bloomberg Surveillance” with Tom Keene and Ken Prewitt. “The Greek situation is tumbling out of hand and I suspect Greece will not be able to avoid a substantial default.” The introduction of the euro and global financial connections mean previous Greek defaults in the 19th and 20th century, most recently in 1932, don’t provide a decent precedent for a failure to satisfy lenders now. “Contagion will be violent” as the price of the two-year Greek note tumbles below 30 cents per euro, predicts Sian. The European Central Bank would be the first responders through purchases of government debt, he says. Greek Banks The country’s banks, of which National Bank of Greece SA (ETE) is the largest, would be the next dominoes. They hold most of the 137 billion euros of Greek government bonds in domestic hands, a third of the total and three times their level of capital and reserves, says JPMorgan Chase. As those bonds are written down and equity wiped out, banks would lose the collateral needed to borrow from the ECB and suffer a rush of withdrawals that likely triggers nationalizations, said Commerzbank AG economist Christoph Balz. “No banking system in the world would survive such a bank run,” said Frankfurt-based Balz. A hollowed-out banking sector wouldn’t be the only danger to an economy that the IMF says will contract for a fourth year in 2012. The Washington-based lender said this week that Greece will shrink 5 percent this year and 2 percent next year, reversing a forecast of a return to growth in 2012. Unemployment is set to rise to 16.5 percent this year, and to 18.5 percent next year, the highest in the European Union after Spain and dry kindling for potential social unrest. Even after saving 14 billion euros in debt repayments, much depends on what deal Greece could strike with its creditors. Debt Load To restore market confidence the debt needs to be pared to below 100 percent of gross domestic product, Stephane Deo, chief European economist at UBS AG, said in a July study that noted national default was “invented” in Greece with the Delos Temple episode. At the time, the IMF was projecting the debt to peak at 172 percent next year. The current debt suggests to him a reduction in the face value of outstanding securities –– or haircut –– of about 50 percent, which would pare the burden to around 80 percent of GDP, the same as Germany and France. Citigroup’s Schofield estimates a writedown of 65 percent to 80 percent, potentially rising as high as 100 percent as the economy slows further. If default is limited to Greece, the fallout may be contained, say Nomura Securities International Inc. strategists including New York-based Jens Nordvig, whose projections allow for an 80 percent haircut. They estimate euro-area banks would lose just over 63 billion euros, with German and French institutions losing 9 billion euros and 16 billion euros respectively. The ECB would face about 75 billion euros in losses on Greek debt it has bought or received as collateral, they say. ‘Large Haircuts’ Such amounts suggest “the losses from Greece-related exposures in isolation look manageable, even in a disorderly default scenario with large haircuts,” though the ECB would probably require fresh capital from euro-area governments, Nordvig and colleagues said in a Sept. 7 report. A debt exchange that was part of the second Greek bailout approved by European leaders in July would impose losses of as little as 5 percent on bondholders, according to a Sept. 7 report by Barclays Capital analysts. The risk is that the rot spreads beyond Greece as investors begin dumping the debt of other cash-strapped European nations, said Ted Scott, director of global strategy at F&C Asset Management in London. Portugal and Ireland have already been bailed out, while speculators have also tested Italy and Spain. Italy, the world’s eighth-largest economy, has a debt of almost 1.6 trillion euros, while Spain, the 12th biggest economy, owes 656 billion euros. ‘Grand Solution’ Those possible ripple effects explain why policy makers won’t let Greece default, said Charles Diebel, head of market strategy at Lloyds Bank Corporate Markets in London. He expects them to strike a “grand solution” in which richer euro countries such as Germany support the weak and begin issuing joint bonds. Policy makers “would only allow a Greek default if they think they can contain the fallout, which is a dangerous presumption,” said Diebel. If Greece, Ireland, Portugal and Spain all impose haircuts, European banks could lose as much as $543 billion with those in Germany and France suffering the most, according to a May report by strategists at Bank of America Merrill Lynch. Even those figures don’t tell the full story because they omit indirect exposure via derivatives such as credit-default swaps. Economists at Fathom Financial Consulting in London calculated in June that U.K. and U.S. banks hold such insurance on Greek debt totaling 25 billion euros and 3.7 billion euros respectively. Extend that metric to the whole European periphery and U.S. banks have a 193 billion euro exposure. ‘Even Worse’ Such linkages threaten an “even worse crisis” than the folding of Lehman Brothers, said Scott. “The amount of outstanding debt is more than with Lehman and we don’t know the amount of derivative exposure.” To support the financial system and stave off an economic slump, Carl Weinberg, founder of High Frequency Economics Ltd. in Valhalla, New York, says governments must create a fund to inject capital into banks as the U.S. did with its $700 billion Troubled Asset Relief Program. “If banks fail, or if they fear big losses, they will stop lending,” said Weinberg. “As things stand today, a credit crunch will corset euroland and a depression will ensue when Greece fails and takes out euroland’s banking system.” –––––––––––––– More at the link |

|

|

|

Quoted:

Quoted:

Quoted:

Quoted:

About to take delivery of the new road warrior machine.... prepare your anus for Dow -666 as punishment from Jesus for my lack of frugality. Ditto, my Cummins-equipped jeep arrives today. I want pictures. This sounds badass. Posted Via AR15.Com Mobile I can't take no credit other than writing a relatively small check. Pictures, man! Pictures! Posted Via AR15.Com Mobile |

|

|

|

Written on Monday, 9/19:

No Hiding Spots Except Despised US Dollar: Equities Red, Metals Red, Energy Red, Grains Red If you have not done so already done so, please consider the possibility there will be no hiding spots except for US dollars and short-term US treasuries (yielding nothing) in a renewed strong downturn. Fixed what appeared to be an obvious grammatical error. It would appear that a strong dollar is contrary to The Bernank's intentions. |

|

|

|

This chart keeps showing up.

The money multiplier is the rate that one dollar can be multiplied once it's created out of thin air by Big Ben Bernanke. The basic concept centers around the fact that once a dollar is magically created and placed into a bank, the banksters need only keep a fraction of its value in their vault. The rest of the deposit leaves the institution as a loan. The borrower then places his new money into another bank, and that deposit is split, a tiny part staying as reserves, and, again, the rest is loaned out to another, and so on. The concept is called fractional reserve banking and ALL banks do it. If it makes you feel uncomfortable, it should. If it makes you want to keep your reserves at home and forego the whopping 50 cents for every hundred dollars you deposit with your kindly banker, even better. What the chart shows is that no matter what bailout we're looking at, no matter what round of quantitative easing (QE) we're examining, the so-called stimulus dollars did not enter the marketplace. The absurd reality of this picture is that it has a reading of below 1. An argument could be made that for each dollar in stimulus going into the market, part of the dollar is being destroyed. In short, the only thing the stimulus has done is stall the fall. Their money multiplier is broken. People are not borrowing, banks are not lending, and the efforts of our Keynesian lot have all been for naught.

We all know money is flowing into the banks. However, the velocity of money, which is the number of times one dollar is used to purchase final goods and services, clearly shows it's not heading where it's needed. So, apart from my showing you that I have a really cool new app for my iPad, what does it mean for your investments? It means that hyperinflation should not be a near-term concern. It also indicates that the deflation monster the Fed has been fighting for the past three years is very real indeed. From here |

|

|

|

Quoted: Written on Monday, 9/19: No Hiding Spots Except Despised US Dollar: Equities Red, Metals Red, Energy Red, Grains Red If you have not done so already done so, please consider the possibility there will be no hiding spots except for US dollars and short-term US treasuries (yielding nothing) in a renewed strong downturn. Fixed what appeared to be an obvious grammatical error. It would appear that a strong dollar is contrary to The Bernank's intentions. It's his own catch 22. Damned if you do, damned if you don't. |

|

|

|

Went with Ford because of bailouts and because my 5.9l only lasted 148k miles. 6 hours in my "new" 09 F250 has me steaming mad, mostly at myself, engineers, and the EPA.

|

|

|

|

Welp, the local grocery store has a 50% off sale today.

That's because they just posted signs that they're going out of business. Practically nothing left in the store already. |

|

|

|

Quoted:

Welp, the local grocery store has a 50% off sale today. That's because they just posted signs that they're going out of business. Practically nothing left in the store already. Visiting my hometown for a much needed vacation. Most of the old businesses that I remember are gone, all within a couple years. Almost all of the industry that was here is gone. Posted Via AR15.Com Mobile |

|

|

|

Quoted:

Went with Ford because of bailouts and because my 5.9l only lasted 148k miles. 6 hours in my "new" 09 F250 has me steaming mad, mostly at myself, engineers, and the EPA. Why? |

|

|

|

Yes.

From: You Ain't Seen Bad Yet But It's Comin' 8/1/2009, pg. 48- Quoted:

Quoted:

What you are witnessing is indeed madness, but Bernanke is no madman -he is a desperate man. He's doing everything in his power to contain the expansion of a self-sustaining, debt implosion-induced, fiscal event horizon. The debt-based fiat money star is collapsing in on itself and sucking in the rest of the US economy. No one is safe, not even light can escape. The FRED charts indicate the undeniable- that the financial crisis is entering a dangerous new phase. I can assure you that, if these trends continue to the point of aquiring momentum, the threat to the greater US economy is enormous: The FED is losing it's fight to buy time; the money-creation machinery of our nation's financial system... ... is rolling over.

|

|

|

|

Pm's down= time to buy. Inflation will hit sometime soon.(already has) Dollars in the bank= dollars lost right now. Maybe some day when intrest rates get above .nothing, we can put it back in the bank.

|

|

|

|

Quoted:

Quoted:

Welp, the local grocery store has a 50% off sale today. That's because they just posted signs that they're going out of business. Practically nothing left in the store already. Visiting my hometown for a much needed vacation. Most of the old businesses that I remember are gone, all within a couple years. Almost all of the industry that was here is gone. Posted Via AR15.Com Mobile

|

|

|

|

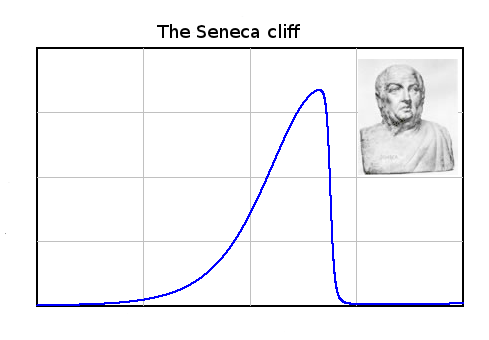

Folks, if you are of the mind that America is most likely poised for a gradual decline and haven't already pondered the following, now is the time to consider Charles Hugh Smith's insights on correspondent David P.'s brilliant synthesis of ideas expressed in Ugo Bardi's energy treatise:

"It would be some consolation for the feebleness of our selves and our works if all things should perish as slowly as they come into being; but as it is, increases are of sluggish growth, but the way to ruin is rapid." Lucius Anneaus Seneca |

|

|

|

Quoted:

Pm's down= time to buy. Inflation will hit sometime soon.(already has) Dollars in the bank= dollars lost right now. Maybe some day when intrest rates get above .nothing, we can put it back in the bank.  How are we going to have inflation when few have money and a job??? |

|

|

|

Unfortunately, there yet abides a threat to our nation's economy- an unthinkable eventuality which directly addresses EXPY37's query... From: How much time has to pass before Doom and Gloomers admit there will be no collapse??? Pg 48, 5/23/2009. Originally Posted By: fnfal_308

Hmmm.... I can't decide what I'd rather have...a deflationary depression Or a hyper-inflationary depression. But that seems to be what we face, depending on what Ben Bernanke does. There seems to be cons and cons to both of them (as opposed to pros and cons) Hyper inflation could make it real easy to get out of debt - IF wages go up along with prices. And that's a big fucking if. Deflation means there are a lot of really good deals out there on houses and cars...you just need a job to pay for it Quoted:

There is a relatively low, but growing probability that we could actually see a hybrid horror scenario, wherein we enter into economic hypercontraction, with the end-result being a deflationary superdepression and a worthless (not inflated, or, even hyper-inflated -I said, WORTHLESS) currency. |

|

|

|

Quoted: Quoted: Went with Ford because of bailouts and because my 5.9l only lasted 148k miles. 6 hours in my "new" 09 F250 has me steaming mad, mostly at myself, engineers, and the EPA. Why? 13.3 mpg hwy, nuff said. |

|

|

|

Quoted: How are we going to have inflation when few have money and a job??? Unfortunately, it isn't that simple. Plenty of people were out of work and without money during the inflation events in Germany, Argentina and Africa. |

|

|

|

Quoted:

Quoted:

How are we going to have inflation when few have money and a job??? Unfortunately, it isn't that simple. Plenty of people were out of work and without money during the inflation events in Germany, Argentina and Africa. I agree IN THOSE CIRCUMSTANCES. Back then there were PLENTY of countries [basically the entire Western world] [artificially propped up in some most cases] that were 'economically viable' and they mitigated the collapse in the named countries. This time, where will 'economically viable' countries willing prop up the entire Western World be coming from to ride to the rescue or at least mitigate economic collapse? A problem is, folks aren't analyzing the BIG pix and considering the scope of the potential collapse we're facing. What's coming down the pike is UNPRECEDENTED and there is NO ONE or any entity that can undo the monster we all have created in our respective countries by our neglect and inattention. [And greed] The 'friction' post above is one possible senario that I have worried about for 14 years ––but not understood the mechanism that could trigger it, that there could be a relatively sudden collapse. As the collapse we're watching progresses, I expect all Western .govs to pull out all stops [look at Europe] to smooth the fall and also use the opportunity to acquire essentially unlimited power and control resulting in the eventual planned complete totalitarian takeover with the loss of most of our freedoms. Look what Europe is doing!!! Nothing that has ANY possible long term positive effect!!! Only long AND short term NEGATIVE effects. Putting gas on the fire! EVERYONE refuses to address what REALLY needs to be done to fix these problems because the answers are too unpalatible to begin to discuss. No one here even touches on a realistic fix... [Well I have from time to time...] Sadly, this is the senario that's IMO most likely baked in our economic/political/social cake. This is what 'Preppers' are unknowingly prepping for and they have no idea [or interest because the issue doesn't involve BOB's or EBR's] what the REALITY that is going to hit them and their families squarely in the face is all about. What's coming is almost a sort of natural correction by Nature and there will likely be little man-made 'compassion' throughout the process. It's gonna hurt. Bad. |

|

|

|

Something else to ponder.

For those fortunate to have lots of $$$ in savings, etc and are looking forward to deflation, wipe the grin off your face. When/if deflation and collapse come, the resulting destabilization of our .gov structure will likely mean your $$$ will quickly be stolen from you before you even know what's happened. The presently wealthy I expect to decend to the bottom with the rest of the masses with the exception of folks who have the right connections, .gov jobs, etc. We'll likely become a cross of Cuba, Mexico, Russia and Argentina. [The last one's for you FF] |

|

|

|

Quoted:

For those fortunate to have lots of $$$ in savings, etc and are looking forward to deflation, wipe the grin off your face. When/if deflation and collapse come, the resulting destabilization of our .gov structure will likely mean your $$$ will quickly be stolen from you before you even know what's happened. The greater danger is wealth vaporization. You know all that debt? Some of it, including sovereign debt, won't be paid back. Are the savings you hold the part that won't be paid back? |

|

|

|

EXPY, I'm receiving you loud & clear- The vast majority of Americans, including many of those who "have something", simply have neither clue nor concept what enormity of magnitude is possessed by that which now threatens to hit them. You're coming in 5-by-5.

ETA: Mcgredo, X-Ring. |

|

|

|

Quoted:

EXPY, I'm receiving you loud & clear- The vast majority of Americans, including many of those who "have something", simply have neither clue nor concept what enormity of magnitude is possessed by that which now threatens to hit them. You're coming in 5-by-5.

ETA: Mcgredo, X-Ring. Roger!!! We were at a social event this PM with some modestly affluent folks, mostly of a conservative bent, and I pretty much was able to keep my trap shut about these issues until near the end. One lady married to a Dupont was explaining how if we were able to elect a repub as prez that he could turn around the economic issues we're experiencing with proper leadership. HAHAHAHA!!!! That did it I explained they would be marginalized and demonized and drug thru the mud by the marxists and the MSM and couldn't do anything because the folks in the USA don't want to talk about any PAIN. That they just want to watch their flat screens and smoke dope.

Then she started on the banksters and how this was all their fault and they should be better regulated. I calmly explained that banksters and politicians were sort of like vultures and were only doing what they do when left unsupervised. Who was going to regulate/supervise them? Then she said she thought the 'pendlum' would swing back and we would move toward a recovery like 'recessions' in the past. I patiently explained this time it was 'different' and once an economic collapse worked it's way through and there was no longer sufficient meaningful productivity to generate a GDP that was even close to our outflow [we're already there and getting worse, FAR worse...] we were screwed and the country would likely be lost to the Marxists in accordance with their ongoing engineered destruction of our middle class. By that time she started worrying saying what a doom and gloomer I was and what was she to do to protect her stocks and realestate and her financial advisor in Connecticut said blah, blah, and I suggested what he is going to do is steer her to the poorhouse and loose her $$$. We must have talked over an hour and I explained that she and I and the rest of us were responsible for things getting bad like this and not to shift the blame to the politicians and banksters. She pretty much understood but went right back to her comfortable belief system just like everyone else I talk with. After tonight she's just beginning to feel what's coming. Some might think 'splaining this stuff to the womenz would make me persona non grata but they LOVE it! |

|

|

|

Quoted:

Quoted:

For those fortunate to have lots of $$$ in savings, etc and are looking forward to deflation, wipe the grin off your face. When/if deflation and collapse come, the resulting destabilization of our .gov structure will likely mean your $$$ will quickly be stolen from you before you even know what's happened. The greater danger is wealth vaporization. You know all that debt? Some of it, including sovereign debt, won't be paid back. Are the savings you hold the part that won't be paid back? Serves the greedy investors right. My savings isn't in that and I'll still be at risk w/ the rest of them. There's likely gonna be a lot of folks jumping off balconies. |

|

|

|

Without investment no one will have a job. Greed is good so is Pride but too much of both will kill a man.

|

|

|

|

Quoted: ^ If congress got off their ass and passed the new Jobs bill the world will be saved. A commercial told me so. |

|

|

|

The IMF needs more $$$, lots more $$$$. Apparently bailing out the EC/World is expensive.......

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Christine Lagarde: IMF may need billions in extra funding Christine Lagarde has signalled that the International Monetary Fund (IMF) may have to tap its members – including Britain – for billions of pounds of extra funding to stem the European debt crisis. The head of the IMF has warned that its $384bn (£248bn) war chest designed as an emergency bail-out fund is inadequate to deliver the scale of the support required by troubled states. In a document distributed to the IMF steering committee at the weekend, Ms Lagarde said: "The fund's credibility, and hence effectiveness, rests on its perceived capacity to cope with worst-casescenarios. Our lending capacity of almost $400bn looks comfortable today, but pales in comparison with the potential financing needs of vulnerable countries and crisis bystanders." The suggestion came after European officials revealed they were working on a radical plan to boost their own bail-out fund, the European Financial Stability Facility (EFSF), from €440bn (£384bn) to around €3 trillion. The plan to increase the EFSF firepower is the crucial part of a three-pronged strategy being designed by German and French authorities to stop the eurozone's debt crisis spiralling out of control. It also includes a large-scale recapitalisation of European banks and a plan for an "orderly" Greek default. Although Britain is not involved in the large-scale eurozone bail-out projects, it is liable for 4.5pc of IMF funding. |

|

|

|

Quoted:

Quoted:

How are we going to have inflation when few have money and a job??? Unfortunately, it isn't that simple. Plenty of people were out of work and without money during the inflation events in Germany, Argentina and Africa. Inflation comes from either too much money supply diminishing the perceived "value" of what you buy (money printing and commodity inflation) - or from the buying madness of a mindless mob (iPad2 or people who are starving). So it's not just "inflation," it's really inflation of core necessities like food, water and utilities. The luxuries of life actually tend to deflate slightly, as resources are stretched and consumers start becoming more frugal. As they divert their resources towards fewer and fewer items (such as imported "necessities"), buyer competition heats up and you get $100 loafs of bread when every parent in the neighborhood is standing in line willing to do whatever it takes to feed their kids. Meanwhile, electronics, PMs and whatever else is sold off at firesale prices to get people liquid. Not saying we're there yet, but that's the idea - and that's what also happened in the areas mentioned to some extent. You don't *need* an external country to create rapid internal inflation in a country (but they'll be happy to sell into it). That's also why we call PM's a "store of wealth," as when the SHTF they will also have minimal value to all but the most well-prepared. |

|

|

|

SEC May Recommend Legal Action Against S&P

Wonder if the SEC is looking at Moody's and Fitch. From the comments: Radical_1 | Sep 26, 2011 08:43 AM ET Clearly a retalitory move for the down-grading of the USA Credit rating otherwise this would have been done in 2008-09!!! Maybe the SEC is done downloading porn and actually has time for enforcement issues. |

|

|

|

Quoted:

SEC May Recommend Legal Action Against S&P Wonder if the SEC is looking at Moody's and Fitch. From the comments: Radical_1 | Sep 26, 2011 08:43 AM ET Clearly a retalitory move for the down-grading of the USA Credit rating otherwise this would have been done in 2008-09!!! Maybe the SEC is done downloading porn and actually has time for enforcement issues. Chicago politics/dirty tricks and now in effect for Washington DC. - Just as many of us predicted after the election. |

|

|

|

Quoted:

<snip> That they just want to watch their flat screens and smoke dope.

<snip> FLAG ON THE FIELD for blatant misuse of my emoticon.

|

|

|

|

CNBC video: US in Depression or Recession?

Schiff @ 3:16, We're gonna keep pouring gas onto the fire until we incinerate the whole economy. Mr. Schiff's political dabblings have served him well; he has learned to not allow the opposition to control the debate by interrupting as he presses home his point. Consequently, he's promptly -AND rudely, ushered off the stage- but boy, did The Schiff Hit The Fan this time! -and this time, he's hittin' on all 8.

Also, VERY important- YOU MUST SEE the Kudlow healthcare fraud piece immediately following the schiff vid! |

|

|

Win a FREE Membership!

Win a FREE Membership!

Sign up for the ARFCOM weekly newsletter and be entered to win a free ARFCOM membership. One new winner* is announced every week!

You will receive an email every Friday morning featuring the latest chatter from the hottest topics, breaking news surrounding legislation, as well as exclusive deals only available to ARFCOM email subscribers.

AR15.COM is the world's largest firearm community and is a gathering place for firearm enthusiasts of all types.

From hunters and military members, to competition shooters and general firearm enthusiasts, we welcome anyone who values and respects the way of the firearm.

Subscribe to our monthly Newsletter to receive firearm news, product discounts from your favorite Industry Partners, and more.

Copyright © 1996-2024 AR15.COM LLC. All Rights Reserved.

Any use of this content without express written consent is prohibited.

AR15.Com reserves the right to overwrite or replace any affiliate, commercial, or monetizable links, posted by users, with our own.